Dubai: It is early morning or late afternoon in the Middle East as far as recovery of its real estate market is concerned, according to the Colliers International Global Investor Sentiment.

Translated it's 4.30, meaning that on a 12-hour clock the market is near the bottom and will recover once it passes the six o'clock mark.

Investors, according to the survey, believe this will happen within the next 12 months as the minutes tick by to seven o'clock.

This is the global view, in the Middle East investors expect to see the market return to normal by the second quarter of 2011, according to the report.

Predictions are interesting but the structure of real estate cycles has changed.

"Many investors expressed the view that real estate cycles are now shorter and more severe than historical norms, which serves as a warning to others that going forward, market participants will need to be more nimble," said Ian Albert, regional director of consultancy services for Colliers International.

Survey results, furthermore, point to a shifting preference towards high quality and income-producing properties. One survey respondent said: "Capital gains are just a bonus; we buy property for income."

Asset deals

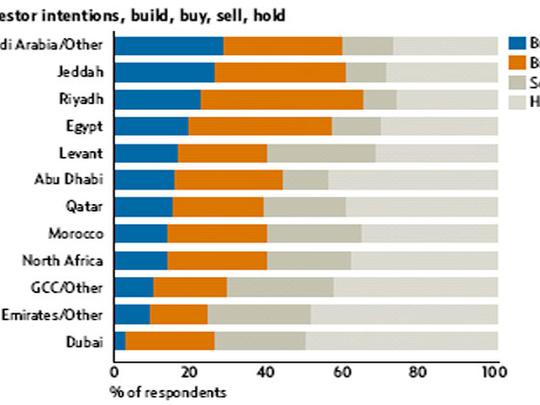

But another survey conducted by Jones Lang LaSalle MENA, in association with Cityscape Intelligence, indicates there are only few income-generating properties around. Only few asset deals in the region see the light these days, according to the survey.

This despite investors recognising that the UAE is still the region's most competitive market thanks to its infrastructure. Potential buyers exceed sellers by 16 per cent in Abu Dhabi and eight per cent in Dubai.

"In spite of the subdued markets, as far as institutional investors are concerned there are currently more active buyers than sellers of real estate in comparison to last year.

"This has not led to any increase in deal flow as there has been a limited amount of institutional-grade real estate assets with strong revenue streams being offered for sale," said Andrew Charlesworth, head of capital markets at Jones Lang LaSalle MENA.

The lack of capital to finance acquisitions is also being blamed for absent deals. Institutional investors prefer to buy good deals and hold, but sellers are digging their heels in on the price.

According to the report, investors expect a marginal value growth in Abu Dhabi at a 12.1 per cent yield, but expect Dubai's growth to remain flat at a lower yield of 10.5 per cent.

The bulk of those surveyed see a recovery of the real estate market in Abu Dhabi possible within the next six to 12 months, but Dubai won't recover before another year or two.