Los Angeles: The number of Californians entering foreclosure slid dramatically in the second quarter to a three-year low, as the fallout from the worst of the housing crisis continues to abate.

Default notices, the first stage of the foreclosure process initiated by banks on troubled homeowners, plummeted 43.8 per cent in the second quarter over the same period last year to 70,051, and 13.6 per cent from the first three months of the year, research firm MDA DataQuick of San Diego has said.

Banks are pushing alternatives such as loan modification programmes and short sales, in which a property is sold for less than the value of the mortgage, helping to reduce the number of people entering foreclosure. A modest recovery in home prices also means that fewer homeowners are likely to sink "underwater", a situation in which a property is worth less than its mortgage, considered to be a predictor of whether a homeowner will walk away.

"The most important thing is that the housing market has stabilised; that house prices are up and not down anymore," said Kenneth Rosen, a professor at the UC Berkeley Haas School of Business. "People are now able to do a short sale, and they may not be as underwater as they were, so improving markets are really a good part of this."

Banks stepped up their seizure of homes from people already ensnared in the repossession process in the second quarter, reflecting an effort by economically resurgent financial institutions to clear troubled loans off their books after having survived the depths of the banking crisis. Many of those loans went into default months ago, taking an average of 9.1 months to get through the process, DataQuick said.

The plunge in default notices was experienced throughout California, including places such as the troubled Inland Empire and the state's Central Valley, resulting in the fewest new defaults since the second quarter of 2007. Default notices peaked statewide in the first quarter of 2009, when 135,431 households received filings, contributing to a steep slide in prices as bank-owned houses sold at extreme discounts.

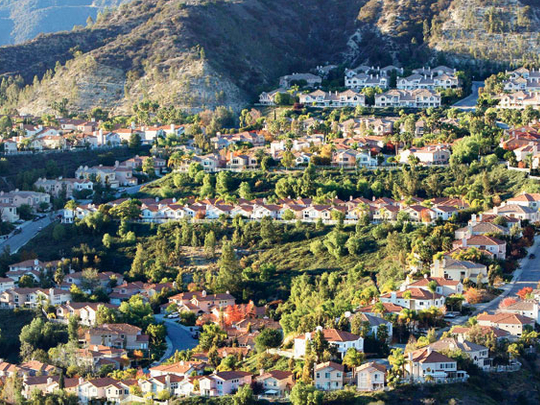

The least expensive regions of the state continued to be the places where people were most likely to receive notices of default. An analysis of the state's most affordable ZIP Codes by DataQuick, representing about 25 per cent of the existing housing stock, found that these areas accounted for about 40.1 per cent of all defaults in the second quarter. Neighbourhoods with a median sales price of less than $300,000 (Dh1.1 million) saw 10.6 default notices for every 1,000 homes, compared with 2.9 for every 1,000 homes in areas with a median price above $800,000. "We are now three-plus years into the housing crisis, and at this point of time we are seeing stabilisation across the board," said Stuart Gabriel, Director of UCLA's Ziman Centre for Real Estate. "The stabilisation is in fits and spurts ... but it is evidenced in a variety of indicators."

The mortgage meltdown made most sub-prime and non-traditional loans unavailable, and the bulk of mortgages in the intervening three years have been fixed-rate loans made to solid borrowers. These loans are generally performing better than the poorer-quality ones being flushed out of the system. The Southland's housing recovery has held its ground for more than a year, even though sales in recent months have been fuelled by federal and state tax incentives. Buyers have included first-time purchasers as well as investors packing courthouse steps to scoop up foreclosures and bidding up prices by tens of thousands of dollars in minutes.

Furthermore, some researchers are beginning to conclude that fewer homeowners may walk away from their properties than previously thought, said Richard Green, Director of USC's Lusk Centre for Real Estate. "There are incentives to avoid default even if you are underwater," Green said, adding that people struggling to pay their mortgages may not be as ruthless in their financial decision-making as some experts had presumed they would be.

Under pressure

With banks booking big profits these days, they're facing increasing pressure from federal regulators to clean up their problem loans.

The number of trustee's deeds, the last stage of foreclosure, filed on California properties increased 4.4 per cent from the same quarter a year earlier, and 11.2 per cent from the previous quarter, for a total of 47,669. Real estate professionals said the increase in foreclosure activity also has to do with the steadying housing market. Now that prices have bottomed, banks feel comfortable putting more inventory. "It's a little bit busier, and everything is selling pretty fast," said Leo Nordine, a Los Angeles real estate agent.