Dubai: Sell or hold?

Property owners in Dubai with ready units are definitely prepared to ‘hold on’ as they find themselves at a price disadvantage to offplan sales from developers.

According to market sources, these property owners are better off by being patient than be in a hurry to sell. Because data shows that for the majority of ready homes, the sellers may not get the asking prices. It doesn’t matter whether the property is in the Downtown, Dubai Marina or the JVC, ready home prices are at a discount to offplan.

This places property owners with ready units in a bit of a bind. While demand and property prices in the Dubai real estate continues to run hot, these potential sellers find they still need to wait if they are to get anywhere near the values they want.

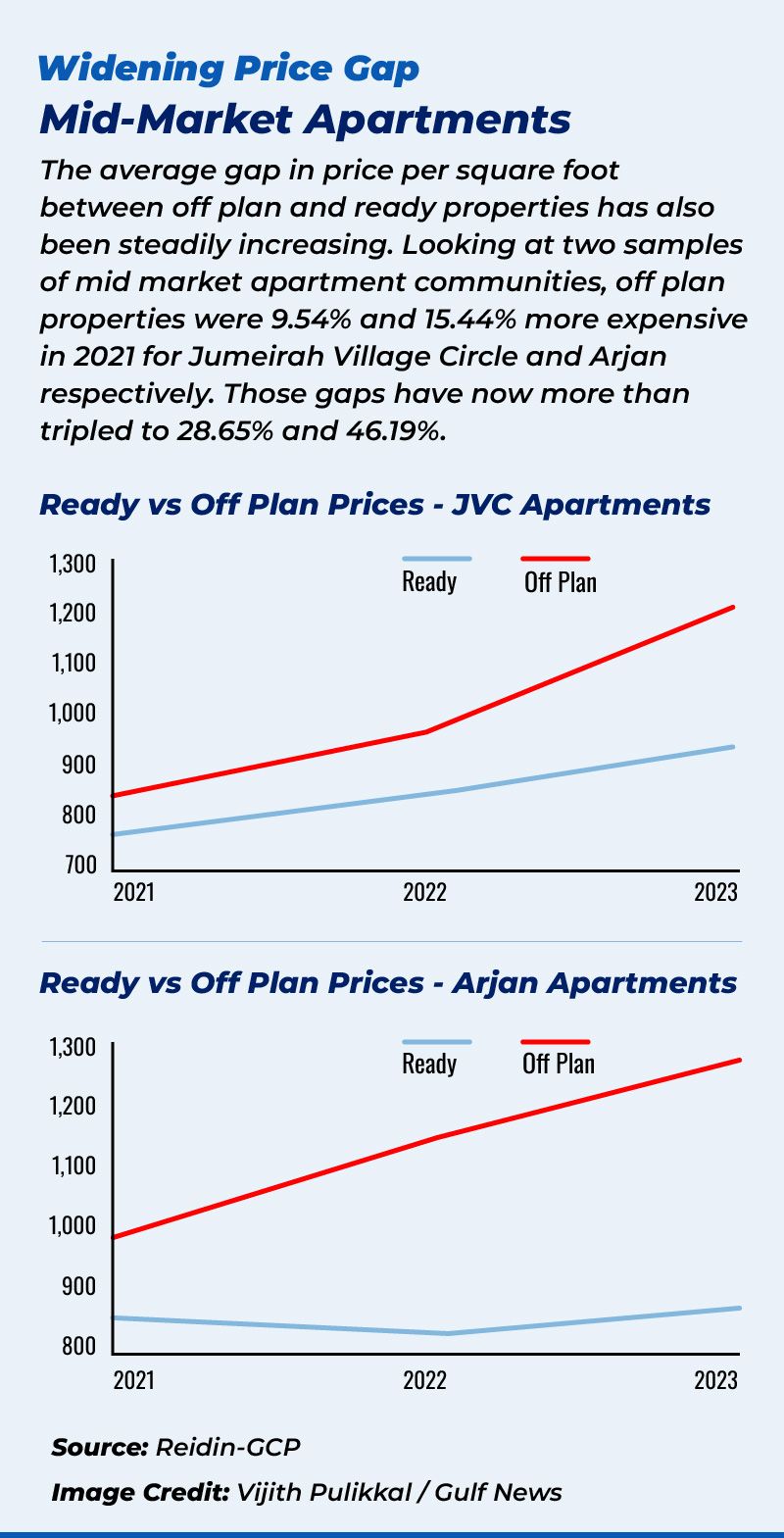

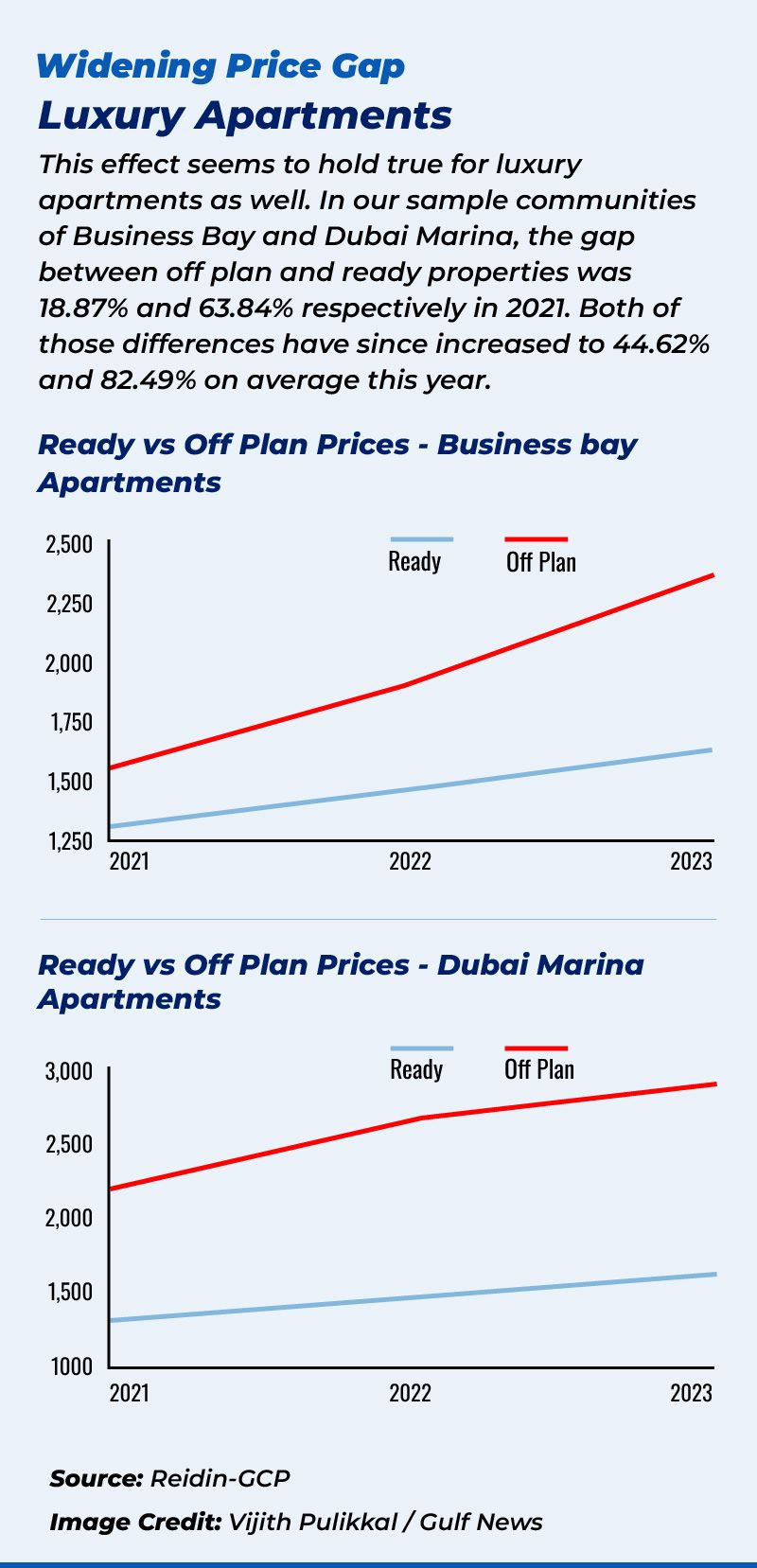

“The average gap in price per square foot between offplan and ready properties in Dubai has been increasing,” says a new report from Reidin-GCP.

50% price gap - even higher

The gap has widened in recent months across the majority of Dubai’s freehold locations, and in many cases is as high as 50 per cent. And even higher.

Take Jumeirah Village and Arjan, two of Dubai’s most in-demand spots for mid- to upper-mid freehold buys. “The gaps between offplan and ready are now more than tripled - to 28.65 per cent and 46.19 per cent – compared to 2021,” according to the Reidin-GCP data.

The status quo exists at super-premium locations too. In Dubai Hills, one of the most coveted buyer locations in recent years, a ready villa price comes in a near 60 per cent lower.

At Dubai Marina, ready apartment prices are at Dh1,410 per square foot, while offplan is commanding Dh2,550. At Business Bay, ready property prices are at Dh1,350 against offplan values of Dh2,250.

What explains this price gap?

It’s mostly about end-user buyers turning cautious. End-users are the dominant force behind buying ready homes, as was evident through much of 2021, when the current Dubai property market wave started, and the first-half of 2022.

Mortgage rates were at their lowest, and Dubai property values were still coming off the 2018-2020 lows. Many of these buyers had the cash to fund a significant part of the payment, and banks were only too willing to do the rest.

It was also the time investors started piling into the local real estate, with Dubai holding its own as among the top performing property markets in the world. It’s these investors who are now forced to delay their exits because of the ready vs. offplan price gap.

Price gap between offplan and ready homes sales has been growing over the past three years. This trend appears to hold true across both apartment and villas, as well as luxury and mid-market communities

Fast forward to now – mortgage rates at their peak, which means end-user buying demand has seen a softening. Plus, developers are getting hyper aggressive on offplan sales – which now make up more than 70 per cent of overall residential deals in Dubai. It means buyers have more time on their hands to pay off, or take mortgages on the units.

Of course, there is also the 20-30 per cent increase in property values over the last 2 years.

We believe they (property investors with ready homes) can still afford to wait out until the price gap between ready and offplan reduces

“A number of sales we made in 2021-22 were to mortgage-backed buyers, and now they are not selling because they are waiting for higher prices in the ready market,” said Daria Mazolevskaya at Dubai-based Investment Experts.

“We believe they can still afford to wait out until the price gap between ready and offplan reduces. Remember, most of these mortgage buyers are still on fixed-rate payments, which are still at under 4 per cent.

“Typically, they have another year for the mortgage rates to become variable – and that gives them the cushion to wait for the gap to close.”

The Reidin-GCP report sure reckons for the price gap to become less obvious soon enough. Once offplan launches and prices start to stabilise/drop, there could be a natural shift towards ready homes among buyers.

If mortgage rate cuts happen at some point in 2024, that too will help. “This divergence in off plan and ready prices is unlikely to sustain,” says the Reidin-GCP report. “Buyers - and investors - can reasonably expect offplan prices to revert downwards, especially as the Dubai market receives more supply.”

Until then, ready property owners can do with some patience…