Dubai: Office vacancies, rents and capital values are still under pressure and the residential market won't recover until next year, according to an industry report.

Jones Lang LaSalle's (JLL) Dubai Real Estate Market Overview Q1 2010 recorded 1.8 million square feet of office space completing in the first quarter of this year, including One Business Bay and O-14.

The report states capital values in Business Bay have dropped by 68 per cent since the peak to around Dh875 per square foot.

At the same time, the expected supply overhang doesn't include enough quality offices in the financial and services sector, representing 50 per cent of what prospective tenants prefer.

The O-14, sold at around Dh1,000 plus in 2007, for example, and adds 165,000 square feet of prime office space with the desired larger floor plate type, to the equation. Two law firms are moving in next month.

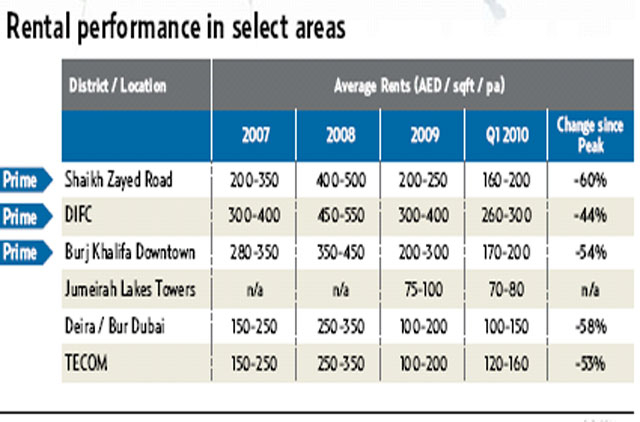

According to the JLL market overview, vacancies in the Central Business Districts, such as Business Bay, Dubai International Financial Centre (DIFC), Shaikh Zayed Road and Downtown Burj Khalifa are going increase at a much slower pace.

However, Business Bay doesn't fall under the prime areas like the others. Rents in prime areas have also fallen over 40 up to 60 per cent, but still fetch between Dh160 and Dh300 in rent and around Dh2,000 a square foot in capital values.

Long-term view

It is less about falling rents and capital values at this time but rather about taking a long-term view, attracting long-term tenants into a well-managed building, said Shahab Lutfi, the CEO of HH, the boutique property developer behind the O-14.

The O-14 only has 16 owners and longer-term leases of three to five years at competitive market rent of Dh120 to Dh150 a square foot. JLS sets the average Grade A rent at Dh200 and sales price at Dh1,260 a square foot with limited transactional evidence.

"Usually tenants don't like to rent in multi-owner buildings and can't command a rent premium. But since we only have a small number of owners, we have signed up agreements to manage their properties so tenants only have to deal with us," Lutfi said.

In the meantime, rents will continue to face a downward pressure on rentals and vacancies could exceed 45 per cent by end-year.

As a result of additional completions, average vacancy levels are expected to increase from their current level of around 35 per cent, said Craig Plumb, head of research at Jones Lang LaSalle, Middle East and North Africa (Mena).

"However, there will be significant variation around this average, with vacancies remaining in the range of 10 per cent to 15 per cent in single ownership buildings in prime locations."

The largest pressure would be on non-prime areas, including Jumeirah Lake Towers, Business Bay, Dubai Silicon Oasis, Tecom as well as Deira and Bur Dubai. Vacancies in the central business district, for example, increased by 10 to 15 per cent over the last quarter.

The report pitches the current office stock at 46 million square feet and future supply at 30 million square feet to come on-line by end of 2011. Of those around 22 million square feet are expected to be completed this year and 8 per cent already have in Business Bay, DIFC, JLT and Tecom.

Rents have halved since the peak encouraging some businesses setting the total demand at the end of this quarter at 2.5 million square feet. However, according to JLL, others are trying to dispose of surplus space of around 300,000 square feet.

"The Dubai office market has swung in the favour of tenants, with rentals continuing to decline over the past three months. This has stimulated additional demand from tenants seeking to move to better quality space on a cost neutral basis. But this is not likely to be sufficient to absorb all the new space expected to complete over coming months," Plumb said.

Additional supply after 2010 will decrease dramatically as developers were able to put a stop on development prior to construction. On the residential side the consultancy expects a recovery of prices at the earliest next year, due to the oversupply levels. Despite significant project delays, around 22,000 additional residential units are expected to be completed across Dubai in 2010.

According to CB Richard Ellis (CBRE) Middle East, vacancy rates continue to vary by location and product offering with a clear two tier market developing. "Demand for space within Grade A buildings, single ownership buildings, and prime locations such as the DIFC, continue to set the pace for both rents and overall occupier interest," said Matthew Green, Head of Research & Consultancy at CBRE. "For some secondary and tertiary locations, vacancies are now creeping up to around 40 per cent. With significant new office space still to enter the market during 2010, these rates could actually increase further before the situation improves for landlords," he said.

"Declining occupancy rates and weak demand levels are also impacting leasing levels across Dubai. However, the overall drop within prime areas is likely to be marginal as compared to lower grade stock in secondary freehold locations," Green said. "At least 10 new office buildings could enter the market from the Business Bay development during 2010. However, this is still dependent on the resolution of ongoing infrastructure issues that seem to be delaying handover of a number of seemingly completed towers."

Asked about his expectations on residential recovery, Green said: "The recovery is obviously heavily linked to growth of expatriate population, and to a lesser degree the migration from other emirates. Improved economic conditions for the year ahead should start to see some improvement in sentiment.

"Considering the volume of new supply and the prevailing weak fundamentals, rates could be further impacted before a recovery is possible. Much like the office sector, a two tier market is being created, with prime product in areas such as Downtown Burj Dubai and the Dubai Marina, holding comparatively firm rates as compared to areas of significant oversupply, such as Jumeirah Lake Towers," he added.

Vacancy rates continue to vary considerably by location and product offering with a clear two tier market developing. Demand for space within Grade A buildings, single ownership buildings, and prime locations such as the DIFC, continue to set the pace for both rents and overall occupier interest.