London used to be one of the biggest real estate markets in the world for foreign capital, but it seems that the bloom is off the rose, at least temporarily. Many investors have moved to remain on the sidelines or already turned away from the market that faces the uncertainty stemming from Brexit.

“The political uncertainty will continue to influence the UK housing market performance because the market will of course be impacted by both future Brexit negotiations and the wider economic outlook,” says Liam Bailey, Global Head of Research at property firm Knight Frank.

Since mid-2016 when sales activity of prime properties hit very low levels in London, price growth has been subdued, he adds, noting that only the weak pound should provide some stimulus for the London market with regards to overseas inward investment, which is, however, a double-edged sword given concerns of rising inflation as a response to current macroeconomic conditions in the UK.

Looking at the numbers, the London housing market has indeed seen better days. According to property advisory firm London Central Portfolio Limited (LCP), sales of newly-built flats were down 41.4 per cent by the end of 2016, compared to the previous year.

We chose ten of the hottest real estate markets in cities that are solid alternatives to London.

Zurich

Switzerland remains an attractive location for real estate investors, with the economic hub of Zurich, where demand for residential properties is highest in the country, offering arguably the best purchase options. For foreign buyers, there is a good time window due to a recent slowdown in the housing market as a result of efforts by the federal government and the Swiss National Bank to cool the market. Currency-wise, as opposed to the euro, the Swiss franc has been relatively stable over the past couple of years.

“Switzerland is viewed almost unanimously as an attractive location for real estate investments,” says Claudio Rudolf, Partner at consultancy EY’s Zurich branch and real estate market expert, adding that while prices of commercial properties are expected to remain stable, prices of residential properties in prime locations are expected to rise owing to demographical changes such as a rapid increase in population mainly through immigration which will have a considerable impact on price trends.

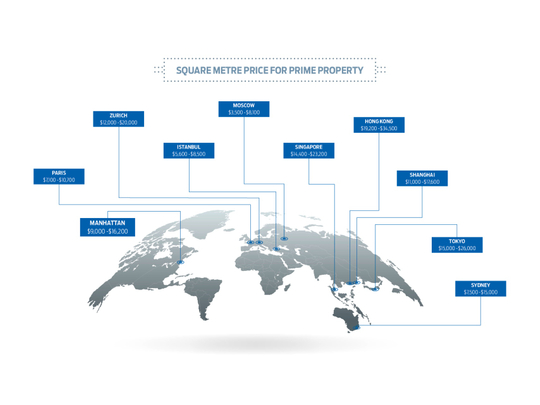

Square metre price for prime property in Zurich city centre: $12,000 (Dh44,075)-$20,000

___________________________________________________

Hong Kong

Hong Kong overtook London as the world’s top luxury real estate market in 2016 as a result of the influx of wealthy Chinese buyers despite a significant burden from stamp duties, according to Dan Conn, CEO of Christie’s International Real Estate, the luxury real estate arm of UK-based auction house.

“In addition to the Hong Kong real estate market’s long history of healthy financial performance and market stability, the city scored highest in almost all our residential metrics, namely record sales prices, average price per square foot, the numbers of sales and listings, absorption rate, the percentage of non-local buyers and second-home owners,” Conn said.

The peace of mind Hong Kong provides for property buyers is reflected reflect in the fact that the city registered four residential sales above $100 million in 2016 and set a world record with a $270-million home sale last year.

Square metre price for prime property in Hong Kong: $19,200-$34,500

___________________________________________________

Manhattan

While London is struggling, New York City’s most prestigious district of Manhattan continues to attract prime apartment and town house buyers. Price appreciation has been pretty stable over the past decade. The median sales price in 2007 for Manhattan condos was $860,000, and that price jumped by 28 per cent to $1.12 million in 2016, according to numbers from Douglas Elliman Real Estate, the largest brokerage in the New York Metropolitan area. As for town houses, median sales prices were at $3.1 million in 2007 and have since leapt by 58 per cent to $4.9 million. But the sky seems to be the limit: For example, a 1,114-square metre town house just steps from Central Park came on the market in June 2017 with a price tag of $37.5 million, more than three times the price it was bought by its current owner in 2002. Location-wise, the area at the southern end of Central Park, particularly 57th Street between 5th and 8th Avenue, offers high-end condominiums, while the area between Sutton Place and the gentrified neighbourhood of Hell’s Kitchen currently holds a lot of opportunities for buyers.

Square metre price for prime property in Manhattan: $9,000-$16,200

___________________________________________________

Sydney

Australia’s largest city is another destination for international property buyers to look at, but this time with caution. Sydney over the past years has experienced a property party with rapidly climbing prices, and observers expect that the booming market could hit an inevitable ceiling, probably as early as this year after a five-year bull run in which prices surged by a whopping 75 per cent in the inner city and in upscale suburbs.

Brendan Rynne, chief economist at KPMG Australia, says that house prices in Sydney were currently 14 per cent over their long-term median and a correction was likely, but it would be a gradual one and not a sudden drop since low interest rates, promotions targeting foreign property investors, strong population growth and supportive government policies keep underpinning the Australian property market. That said, timing is an important factor when preparing to purchase real estate in Sydney where median prices are expected to peak around $742,000 in 2019, up from $666,000 in 2016, and then gradually ease to around $712,000, according to KPMG Australia.

Square metre price for prime property in Sydney: $7,500-$15,000

___________________________________________________

Paris

Real estate prices have been on the rise the recent past in the French capital, but are still comparably reasonable for international prime destination standards. While median prices dropped seven per cent between 2011 and 2015, they were up five per cent in 2016 and are expected to climb further at this rate, according to figures from Paris Property Group, a French real estate brokerage focusing on international clients. The growth cycle is supported by mortgage rates hovering at all-time lows, while another factor is that a considerable number of UK citizens, troubled by Brexit, seek to get their hands on prime flats as a second home in the European Union or possibly for emigration purposes. The result is that square metre prices for prime property in the city’s well-heeled districts have risen to more than $10,000.

Square metre price for prime property in Paris: $7,100-$10,700

___________________________________________________

Shanghai

House prices have started to cool off after a decade-long real estate frenzy which propelled Shanghai into the top ten of the world’s most expensive cities to buy property on Knight Frank’s Prime International Residential Index. Now, with the Chinese government’s new market curbs to avoid a housing bubble, price increases have slowed down, at least for Chinese standards. In Shanghai, home prices rose just in low double-digit per cent figures this year — monthly.

Developers, faced with those skyrocketing prices, tended to shrink the size of what they market as luxury apartments to around 100 square metres from the previously common 200 to 240 square metres. Such a resized home now averages around $1.5 million. Interested buyers can get an impression at this year’s Luxury Property Show in Shanghai in December.

Square metre price for prime property in Shanghai: $11,000-$17,600

___________________________________________________

Tokyo

Owning an apartment in Tokyo certainly comes with a bit of an exotic touch. However, space can be an issue since most apartments, apart from ultra-high-end units, are comparably small for Western standards as Tokyo’s downtown market is mainly catering to one- or two-person households. Upscale homes in posh city towers and exclusive low-rise mansions in the city’s most upscale districts Shibuya, Shinjuku and Ginza and particularly units around Tokyo Bay come with a hefty price tag, starting from $2.3 million for a 90-square meter one-bedroom to more than $9 million for a three-bedroom spanning over 250 square meters, according to Sotheby’s International Realty, which brokers such property for international buyers with deep pockets. And prices are not expected to go down with the excitement building up for the Summer Olympics 2020. Currently, rented residences in Tokyo yield as much as 8 per cent, compared to Hong Kong’s and Singapore’s one to two per cent.

Square meter price for prime property in Tokyo: $15,000-$26,000

___________________________________________________

Singapore

Analysts and property experts are almost unanimously of the opinion that Singapore’s residential housing market after a four-year downtrend is set to recover as some property restrictions imposed by the government were eased in March and developers now have more leeway. In a note released in April 2017, Morgan Stanley analysts said they expect that an increase in transaction volume will lead to rising property prices as early as in 2018, which will also mark the bottom of the downtrend, and prices are likely to double in the period to 2030 from the current level. Other experts note that the window of opportunity to buy prime property in Singapore was now wide open for foreign buyers.

Singapore’s high-end and luxury properties are now cheap compared with other major cities around the globe, says Brandon Lee, a property analyst at JPMorgan Securities Singapore, adding that prices fell between 15 and 25 per cent since the market peaked in 2011.

Square metre price for prime property in Singapore: $14,400-$23,200

___________________________________________________

Moscow

Moscow’s real estate market is relatively young as it only came into existence after the collapse of the Soviet Union in 1991, but since has seen a steep surge in the number of transactions and prices owing to an open market system where both foreign individuals and corporations can purchase real estate in a process which is the same as for locals. Today, Moscow’s property market is booming and offers bright opportunities and high returns on lifestyle and investments purchases in most cases. “Apartments in new developments are always in demand and generate enormous profits, as do new developments themselves in Moscow,” says Andrey Zakrevsky, senior vice-president of Knight Frank’s Russian branch.

Square metre price for prime property in Moscow: $3,500-$8,100

___________________________________________________

Istanbul

Turkey’s economic hub of Istanbul is a special destination for Middle Eastern second-home investors due to its proximity to the Gulf, its location halfway to Europe and a number of cultural similarities. In addition, prices are comparably low even for prime property in the two city centres east and west of the Bosphorus, and this even though average property values in the city roughly tripled since 2000, according to Kate Everett-Allen, head of international research at Knight Frank.

While overall foreign property investment in Turkey has slowed somehow in the past year due to political uncertainties, Istanbul’s market is still doing well with continued demand mainly from Arab, Iraqi and Russian buyers, who benefit from a low lira exchange rate to the US dollar, dollar-pegged currencies or the euro. In addition, the government, which opened the Turkish property market for foreigners just back in 2012, keeps offering incentives, including no VAT for foreign property investors, a citizenship programme for buyers who invest a minimum of $1 million, as well as lowered stamp duty and decreased land registry fees. In terms of upscale property, areas such as Bagdat Avenue on the Asian side of Istanbul or Istiklal Avenue on the European side are in demand.

Square metre price for prime property in Istanbul: $5,600-$8,500