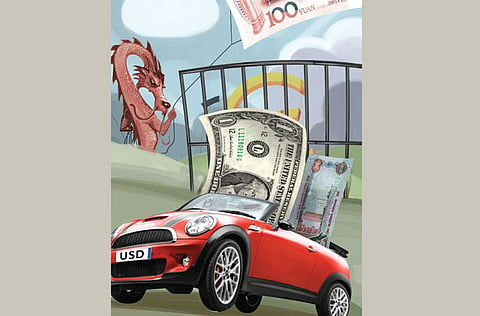

Dollar still king, but diversifying a necessity

Twelve-year-old euro still too unstable to replace dollar

When trade first existed, it took place within a barter economy where goods were exchanged for other goods. And when trade evolved, it included payments in gold coins mainly with the introduction of silver and copper coins later on due to gold scarcity. As it became troublesome to carry gold around, besides the process being risky, paper currency was introduced as to be printed against gold reserves owned by each central bank.

Since there was no way for scarce gold resources to match an increase in global economic activity and output; printing of additional paper currency had to be at specific predetermined ratios of currency to gold; 3:1 for instance.

After World War I, most of the gold reserves in Europe were transferred from UK, France, and Germany to the US to pay for war associated imports. As a result of diminishing gold reserves in the latter European countries, the gold standard was temporarily abandoned as these countries started printing currencies in an uncontrollable manner to cover government spending and to sustain economic activity within their borders. With currencies in circulation doubling, tripling, and quadrupling; the value of each currency headed towards worthlessness.

The shift in trade positions made the US assume the role of a financial mediator; printing US Dollars against its newly acquired reserves using them to pay for its imports from different countries. Therefore, and as the Dollar became widely circulated, newly found economies like that of the UAE found it easier to peg their new currency to the US dollar.

When the seven emirates were united; a Monetary Council was established in 1973 to introduce the UAE dirham to replace the main two that existed at the time: the Bahraini dinar which was equivalent to 10 of the Qatar and Dubai Currency Board Riyals. A total amount of Dh260 million were pumped into the economy to replace “a total of 12.9 million dinars and 131 million riyals”. And in 1980, Federal Law no. 10 declared the establishment of the Central Bank to replace the existing Monetary Council. It also stated, under Article 74, that 70 per cent of the currency in circulation should be covered by assets held in gold while the rest to be covered by foreign currencies, foreign government bonds, and local commercial notes, and others.

When considering different currencies as peg alternatives, one cannot consider the Euro as a perfect substitute for the US Dollar. In fact, the old French Francs, the old German Marks, and even Sterling Pounds were quoted in US dollars when their respective countries temporarily abandoned the gold standard in the 1900s. And right now, with a few bankrupt governments in Europe and the Euro being supported by a heroic Germany; how safe is it to peg the UAE dirham established in 1973 to a 12-year-old Euro?

How about the Yuan? It seems to be gaining popularity since its Asian counterparts are now quoted in it and benchmarked against it. But how assuring can a peg to the Yuan be considering China’s political instability?

Moreover, monetary authorities in China tailor their policies towards sustaining a modestly valued Yuan to encourage foreign investments into the county and exports out of it. In more extreme cases, the Yuan would even be devaluated to achieve China’s economic targets. This doesn’t eliminate the two currencies mentioned or the potential of any other, but instead says that no single currency could assume the US Dollar’s role on its own.

One of the key functions of a country’s central bank is to protect and maintain the stability of the currency. Such a role is essential in guarding not only a country’s wealth and sovereignty, but also the interests of those who hold the currency.

Pegging the UAE dirham to the US dollar is not only for the earlier mentioned history, but for stability purposes that the US dollar was believed to offer. However, with the US being in its current situation, currencies that are negatively correlated to the Dollar and to one another should be considered.

As stated earlier, no single currency can replace the Dollar’s role in the financial world. Yet, that doesn’t mean that the risk of being pegged to only one currency should be diversified.

When referring to the US history and its tendency to print currency when faced with trade deficits, it is very likely that history is repeating itself. And as one country dilutes its international debt by devaluing its currency, others pegged to it get devalued as well. Now the last thought that I want to leave you with is this: what would happen if people knock the Fed’s doors demanding gold for Dollars?

— The writer is a commercial consultant and a commentator on economic affairs. You can follow him on Twitter at www.twitter.com/aj_alshaali

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox