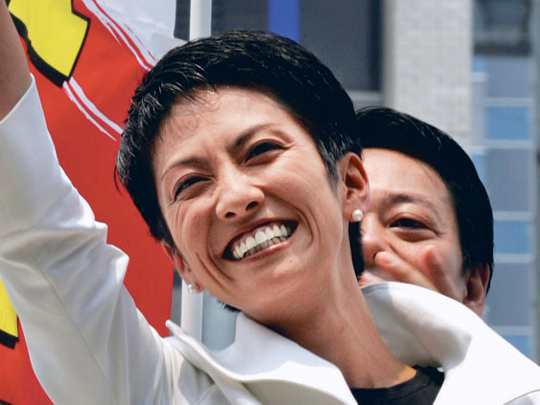

Renho Murata is better known for her swimsuit pinups and TV-presenter past than shaking up the status quo. As new leader Naoto Kan's minister of reform, Renho is about to become the most-feared woman in Tokyo.

She is also one of the reasons investors may be pleasantly surprised by Japan's newest prime minister, the fifth since Junichiro Koizumi stepped aside in 2006. Here are three scenarios that, if realised, might put Asia's largest economy on sounder footing.

One: true fiscal change. Clearly, the emphasis is on "if." This is an economy that's cried wolf too many times. Eight months ago, Yukio Hatoyama led the Democratic Party of Japan in ending 54 years of virtually uninterrupted one-party rule with big talk of reform. And then, nothing. He resigned the premiership last week.

Enter Kan, a fiscal hawk. If there's anything Japan needs to do, it's to convince global investors the nation isn't heading the way of Greece.

As finance minister, Kan, 63, warned that policy makers can't be complacent about issuing ever- growing mountains of debt just because borrowing costs are low. Kan's pick for finance chief, Yoshihiko Noda, says Japan must draw lessons from Europe's fiscal crisis.

Efforts to make sure debt still has buyers have veered into the surreal. That can be seen in a new advertising campaign that suggests, with apparent sincerity, that Japanese women are attracted to men who invest in government bonds. Yeah, right.

To reduce a debt that's roughly twice the size of the $4.9 trillion (Dh17.9 trillion) economy, the DPJ is doing something revolutionary. It's holding public hearings at which lawmakers force bureaucrats to defend their bloated budgets.

And Renho, the single name by which the lawmaker goes, made quite a splash nationally with aggressive interrogations of government staffers.

Less is better

Japan needs more of that, and it's about to get it. Conversations about reining in debt too often focus on tax increases — not a good idea with deflation deepening. It's about spending less, and spending better.

Funds need to be redirected away from wasteful projects and toward pursuits that create quality jobs and increase competitiveness. Japan could actually get more growth out of less borrowing if it spent more creatively.

Lawmakers need to be careful. DPJ leaders want to tread carefully in paring research spending at a time when China and India are upping theirs.

Still, Japan is a fiscal train wreck waiting to happen. Kan's focus on debt is good news for Japan's credit rating and investors to boot.