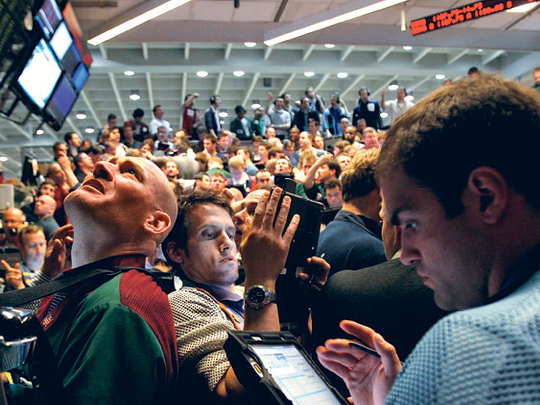

Chicago/New York: The Chicago Board Options Exchange, the oldest and biggest North American options market, is heading toward an initial public offering that would end a four-year drought in flotations by US financial exchanges.

CBOE members on Friday approved a plan to convert their member-owned operation to a shares-based company, paving the way for the long-awaited IPO.

Goldman Sachs is the lead underwriter, with a minimum per-share price of $25 (Dh91.80) for the offering, scheduled for June 15.

CBOE Holdings Incorporated will refine the price range in coming weeks, with current seat prices, future earnings and price-to-earnings ratios at rivals all factors.

On the private market the shares are worth about $28.13 each, based on the most recent sale of a CBOE "seat" or membership on May 20 for $2.35 million. The implied per-share value accounts for a one-time pre-IPO dividend of $100,000 and the 80,000 shares into which each seat will be converted.

The actual value of the shares is likely higher. Exchange seats typically trade at a discount to their equivalent in shares, because they are less liquid.

The offering price is "definitely going to be higher than the minimum amount stated", said Thomas Caldwell, chairman of Toronto-based Caldwell Investment Management, with control of 54 CBOE memberships that will make it among CBOE's top shareholders after the restructuring.

"That would be handing people a bargain basement deal," said Caldwell. Caldwell bought a CBOE seat earlier this month.

At the $25 minimum, the CBOE IPO would raise about $292 million and give the exchange a market value of about $2.57 billion.

It would also give it a price-to-earnings ratio of about 28, lower than NYSE Euronext but higher than Nasdaq OMX, IntercontinentalExchange Incorporated and Chicago Mercantile Exchange parent CME Group Incorporated, according to IPOdesktop.com President Francis Gaskins.

But the exchange's planned restructuring could provide additional dollars that would reduce that ratio significantly.

When the exchange de-mutualises, memberships will be abolished and the CBOE will start collecting monthly fees for trading permits.

The CBOE does not quantify the extra income it expects to generate, but an analysis of fee schedules included in its IPO filings suggests the permits could generate as much as $90 million in new yearly revenue, more than half of which would likely drop directly to the bottom line.

Last year the CBOE earned $106.5 million on revenue of $426.1 million.

On the other hand, competition among exchanges is heating up. CBOE's market share of options traded in the US fell from about 45 per cent in 2000 to roughly 31 per cent in 2009.

"If the stock market were in a bull market they could get away with [a high valuation], but it's not," Gaskins said.

General motors

The Treasury Department has hired Lazard Freres & Company as its adviser to prepare for an initial public stock offering by General Motors Company.

Treasury signed the agreement on Monday but did not reveal it until Friday. The agreement says that Lazard Freres will be paid $500,000 (Dh1,83 million) a month over the next year for the advice it provides the government. The agreement says that if no stock sale has occurred during the first 12 months of the contract, Lazard Freres will receive a reduced fee of $250,000 a month until the sale is completed. The agreement said that the New York-based bank will review alternatives for the government's ownership stake including giving advice on the use of "underwriters, brokers or other capital market advisers for the best means and structure to dispose of such assets." — AP