Dubai : The financial history of the world started in January 2007. An important point this, because if you decide that your version started when they oversold tulips in Amsterdam, or the 1930s Wall Street crash, or Y2K, or 9/11, or a date other than mine; then you will end up with totally different data from mine.

Your graphs will look different, and your market performances will have outcomes founded on a completely different world then the one started in January 2007.

So, for the sake of this piece, financial history started in 2007. Simplifying history thus makes pre-history a very long study in which the world moved from inventing cash as a means of exchange, to running portfolios on the correlated assets (cash, bonds and equities); to the one that espoused globalisation and diversification.

All of that is consigned to pre-history with my New Year's resolution to re-write the start date.

Put another way, the big lessons of the last three years take into account a set of markets we thought were ‘fairly priced' in 2007; to a colossal shake-up in 2008, to a recovery into a different form in 2009.

What lessons emerge from this process (our very own ‘modern history') which will shape our immediate future? Four of them stand out.

Lesson One: The importance of liquidity and debt management.

The sell-offs screaming out in the graphs at right reflect Justice Putnam's Prudent Man Rule, and "do what you will your capital is at risk". Meaning, borrowing against underperforming assets is always dangerous, and what 2007-09 taught us is that there is no asset that can justify uncontrolled borrowing.

No definite value

Assets, as the graphs show, have no definite value — they are prone to wandering — and debt on the other hand is a specific amount reduced by specific instalments.

The lessons under this section include: firstly, do not borrow more than you can afford to repay. Secondly, keep a few months liquidity in the jar.

Lesson Two: The very obvious shift in economic power from west to east.

Equities are still king, but which ones? Pre-history had power vested in the US. It is fair to say that even today, the US is still by far the biggest equity market and the world's strongest economic power.

Forming around half of the MSCI Global index, it explains why the US indices and its global equivalents look similar. Exceptionally well correlated. However, the other so-called ‘mature markets': Europe ex-UK, UK and Japan, have had a dismal modern history.

Compare, however, ‘INCH', India and China where the equity indices have taken the global shake-up in their stride. Compare also the MSCI Emerging Market index (at plus 17 per cent) versus the full MSCI Global market (minus 14 per cent) over three years, and there would seem to be a very clear hint of the areas that will drive the future.

Lesson Three: Beware of complexity, buy the understandable.

This was a 2008 lesson for sure with ‘toxic debt' leading the way. In 2009, there is a lot more emphasis on two easier-to-understand issues: price and intrinsic value.

The new world order contains greater emphasis on fair pricing, where the price of a financial asset can be explained rather than established on future speculative events; and greater emphasis on buying real assets.

The latter would explain why commodity indices have weathered the global turmoil over the last three years. Within these indices are embedded the ‘real stories' of our time: the value of gold emerging as the value of cash wanes against inflation; and the value of energy sources in the absence of anything to replace it.

Lesson Four: The failure of diversification and the momentum from passive to active management.

Whilst there remains much logic in spreading the eggs among many baskets, the fact is that all the baskets fell in 2008, and the fact is that spreading for spreading's sake, and then holding that spread, has limited value.

On the run

The new world order requires asset management of the type that can manage diversification "on the run". This is not the same as selling every time there is a fall. No way.

Future winners will remain loyal to their investments whilst pricing is negative, as long as the reasons why they invested there in the first place remain the same. However, in this world things change fairly rapidly.

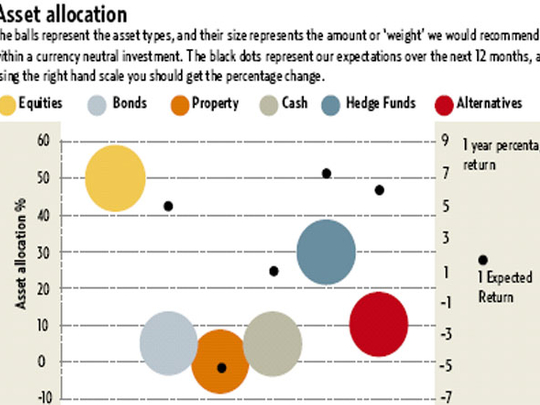

Finally, if asset allocation is all-important, where is the model for 2010? Over to Howard Smith at QIM in London whose view is expressed in the box above: "This is a new tool — it seeks to put our views on recommended weighting into perspective."

The writer is chairman of Mondial Financial Partners.