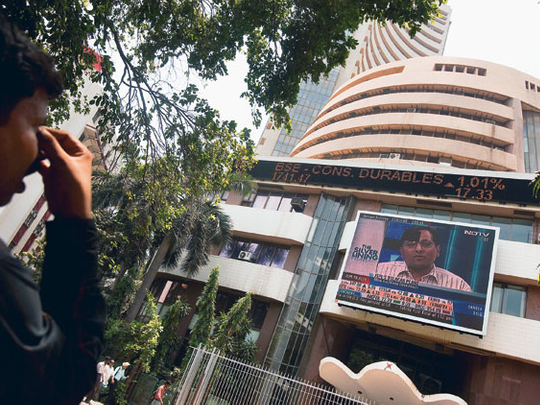

Mumbai : Few investors are willing to build positions in Indian shares ahead of the central bank's policy review at the end of January that is widely expected to drain excess cash from the banking sector as the monetary authority tries to rein in accelerating inflation pressures.

Annual inflation in Dec-ember jumped to 7.3 per cent, the biggest rise in a year, powered by food prices that soared nearly 20 per cent in late 2009. There is concern among policy makers the high food inflation, mainly caused by the weakest monsoon in almost four decades, could spill over to other sectors unless money supply is curtailed.

Economists believe the Reserve Bank of India (RBI) will raise the cash reserve ratio on January 29 by 50 basis points, which will reduce the amount of funds available for loans at commercial banks by about Rs200 billion. (Dh16.04 billion) Although this is unlikely to significantly dent excess cash, which is currently running at around Rs800 billion as reflected in the daily reverse repo auctions, the move will be a harbinger of dearer interest rates.

Beijing last week unexpectedly raised the reserve requirements for banks in China by half a percentage point to head off a possible bubble in asset prices. The measure will put pressure on the Reserve Bank of India (RBI) to act, even though mandarins in New Delhi are against a rate increase at this point in time because the economic recovery is not yet broadbased.

"Given the risk of excess liquidity feeding through to asset and general prices, we expect the RBI to begin withdrawing liquidity through the cash reserve ratio and to hike interest rates gradually," said Tushar Poddar, an economist at Goldman Sachs. "Food inflation is rapidly becoming the key policy challenge as the purchasing power of poor households is being eroded."

Outsourcing

There is evidence that corporate earnings are picking up and the worst of the world economic crisis is behind us. Shares in Infosys Technologies rallied nearly nine per cent last week after the conservative software services company raised its full-year revenue forecast and earnings, betting the pick-up in US and European economies will boost demand for outsourcing.

Tata Consultancy Services, India's largest outsourcer, said on Friday its December quarter net profit rose by a third as it added more than 20 new clients.

US investment bank JPMorgan said it expected the Sensex to rise about 17 per cent to 20,500 by December — after the 81 per cent jump in 2009, the biggest annual gain in 18 years — but warned the ride will not be smooth.

"The growth outlook is healthy," analysts led by Bharat Iyer wrote in a note to clients. "But the ride is expected to be bumpy. Sustainable returns for equities could consequently be back-ended."

Monetary tightening and potential withdrawal of fiscal stimulus packages will likely be potential speed breakers in the market's ascent, they said. In other words, there is every likelihood of the market losing steam in the near term before pulling ahead in the later half.

"The concerns about rate hikes, fiscal stimulus roll-backs and a continued large fiscal deficit due to commodity price increases may lead to a correction in the first quarter," BNP strategist Manishi Raychaudhuri said. "In these circumstances the correct way to position a portfolio is to concentrate on stocks with visible earnings and cash flows, and companies that have a potential valuation and earnings increases."

JPMorgan said investors should buy shares like state-controlled Bharat Heavy Electricals Ltd and leading engineering conglomerate Larsen and Toubro that benefit from the investment cycle, and keep off consumption stocks.

"Corporate earnings have been reviving over the last two quarters and the trend herein is expected to accelerate in synch with the economic recovery," it said.

"Pending clarity on reforms, we believe market performance through 2010 will be driven more by earnings growth than re-rating."

JPMorgan forecast Indian earnings may post compound annual growth of 22 per cent over the fiscal years ending March 2011 and the following year.

The writer is a journalist based in India.