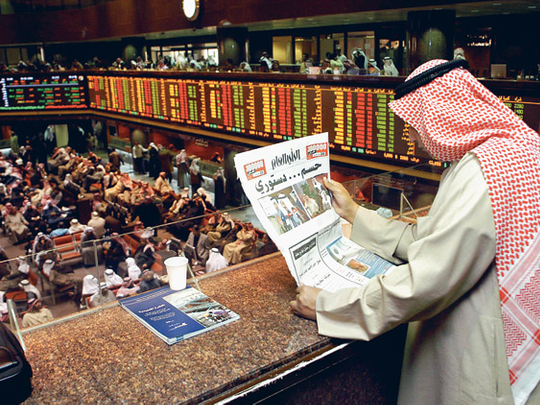

Dubai After a massive destruction of wealth in the form of losses by Kuwait's investment companies, the Central Bank of Kuwait's (CBK) tightened regulation will help improve liquidity and leverage, analysts said.

Earlier this month, the CBK announced tighter regulation over the sector through three criteria spanning liquidity and leverage. The new regulations are effective immediately but the CBK has given the sector until June 2012 to comply fully with the new measures.

According to the CBK, about half of the listed and unlisted investment firms comply fully with all three criteria (see box).

"Given the fact that the CBK's criteria are more stringent than the traditional definition of these ratios, we believe this will alleviate much of the negative sentiment associated with investment companies due to the financial crisis," said Layla Jasem Al Ammar, senior analyst at Kuwait Financial Centre, or Markaz.

"In our assessment, the new regulations aim to increase transparency, credibility and uniformity in the investment sector, which has grown to be of systemic importance to the Kuwait financial sector."

Kuwait's 100-odd investment firms lost more than $2 billion (Dh7.3 billion) in 2009 following a monstrous $3 billion loss in 2008. Losses in the first quarter of this year were more than $100 million.

"The losses are tied to impaired assets which companies have been writing off in an attempt to restore some health to their balance sheets," said M.R. Raghu, head of research at Markaz.

"Liquidity and over-leverage have been an issue for the sector, whose assets often comprise difficult to value and illiquid investments which are then pledged as collateral against further borrowings," he said.

"These issues were not bothersome during the boom periods. However, when the global financial crisis hit, it exposed the sector's vulnerabilities resulting in a massive destruction of wealth."

The analysts believe the CBK move is inspired by its engagement with the Basel II banking accords. Kuwait was the first Arab country to adopt the accords in 2005. "The new regulations may mirror those of Basel due to the similar skill set required in implementation, which CBK would already possess," Al Ammar said.

The new regulations aim to provide a level playing field on which the health of the sector and its constituent firms can be objectively measured and compared. This, the analysts say, would significantly ramp up investor confidence in the country, with a positive trickle-down effect to the banking sector.

According to the International Monetary Fund, Kuwait's investment sector has more assets than its banking sector, making it systemically important to the financial stability of the financial sector and the economy.

New regulations

1. Leverage ratio

The company's leverage ratio (total liabilities to equity) cannot exceed 2:1. Total liabilities has been defined as all liabilities excluding general and specific provisions.

2. Quick ratio

This ratio (also known as the acid ratio) is a stringent measure of a company's ability to service short-term obligations. The CBK circular mandates a stricter calculation of the ratio. The ratio normally entails dividing quick assets by current liabilities. The CBK regulation further constricts the numerator by only allowing for cash and equivalents and sovereign debt rated triple-B or higher.

3. Foreign exposure limit

The CBK mandates that foreign exposure (debt) must be limited to 50 per cent of total equity or 25 per cent of total liabilities (given the leverage ratio limit).