India's obsession with gold is well known. It is one of the countries with mammoth gold holdings and is home to a population mesmerised by gold ornaments. Gold plays a huge part in India's social, cultural and religious psyche. This is evident in the fact that spending levels for the precious metal often increase during holidays, festivals and other auspicious occasions.

If all the gold that Indians have accumulated over generations were combined, it could act as a potent driver to sustain the wealth effect in India. According to an industry report, privately held reserves alone are estimated at 15,000 tonnes, which, at last month's prices, can reach $550 billion. The amount is almost 40 per cent of India's $1.4 trillion stock market capitalisation.

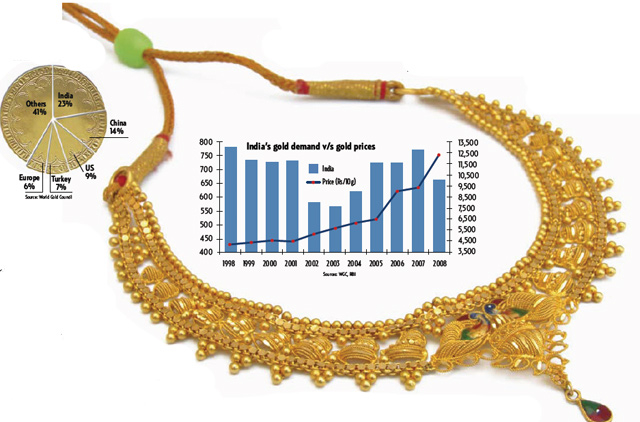

The country's gold sector was not that glittery during the first quarter of last year, when China's jewellery demand expanded, threatening to overtake India to become the world's largest retail consumer market. India retained its top position recently, registering a demand of 180.7 tonnes in the fourth quarter of 2009, up 13 per cent from 159.6 tonnes a year ago.

Solid recovery

The World Gold Council (WGC), in its report released this month, attributes the "solid recovery" to seasonal factors, which include weddings and festivals like Diwali. Other experts, however, cite rising individual incomes as a contributing factor.

Jewellery remains the preferred choice for many Indians, accounting for 137.8 tonnes in the last quarter, compared with 108.6 tonnes a year ago. Net retail investment has recently posted a slight decline from 51 tonnes to 42.9 tonnes during the same period, although a look at trends over the last few years would show a change in consumer attitude.

A special report by HDFC Securities notes that India's net retail investment has actually more than doubled from 90 tonnes in 2003 to 200 tonnes in 2008, which goes to show that many consumers are now looking at gold as an investment.

HDFC sees this as an opportunity for gold coins sale, gold loans or gold exchange-traded funds. (Gold loans, which are also available in Dubai, are often secured by companies in the gold business, from gold mines to jewellery manufacturing and retailing, to eliminate price fluctuation risks on their balance sheet.)

Rising individual incomes will further drive a change in consumer attitude towards gold. Quoting McKinsey estimates, the HDFC report states that the middle class will account for 41 per cent of the population in 2025. This means that in 15 years, about 291 million people will move up from poverty.

Rolf Schneebeli, former head of the World Gold Council, says the future outlook for gold demand in India remains positive. In India, as well as in China, the economy is resuming its growth path. This means that people are making money and are in a good spending mood, which certainly helps gold and jewellery demand.

"It is certainly true that with the clients becoming more affluent, they will tend to buy pieces of jewellery with less gold and more diamonds. However, in India, this effect is more than compensated by more people entering the gold affordability bracket which is the major effect of the rapidly developing economy," Schneebeli tells Gulf News.

"Also, the gold price has been stable recently. Same as in the Middle East, clients tend to postpone purchases when there are sharp price movements. With a more stable price, the buyers will get used to the higher price level of gold and will continue to buy," he adds.