Dubai: Chinese manufacturing companies, hurting from the triple-whammy of declining demand in their traditional Western markets, a stronger currency and increasing production costs, are investing in expanding their export markets, driving domestic consumption and playing to their strengths.

And the Middle East is expected to play an increasingly larger role in this transformation.

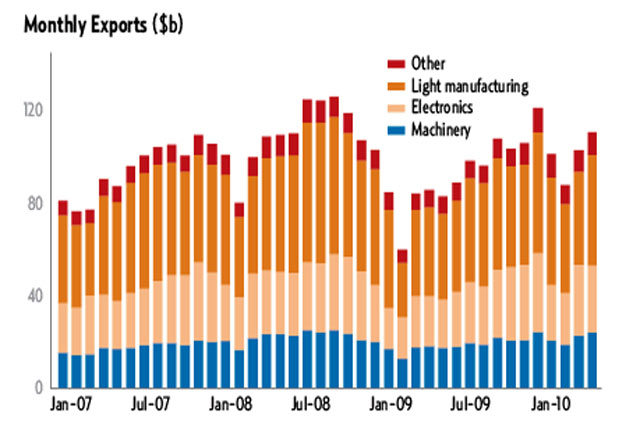

Traditionally driven by exports of globally competitive products, China's economy has been showing signs of slowing growth. The nation has witnessed a dramatic decline in its current account surplus, which today stands at half its 2007 peak of $372 billion (Dh1.3 trillion).

A global slowdown in spending over the past three years of a financial and economic meltdown has slashed demand for goods overall, but the International Monetary Fund (IMF) estimates that this demand will return as economic recovery takes hold.

"Yes, our manufacturing companies are exporting less. Yes, they are paying more in terms of salaries and production costs. But for the next few quarters they will have to settle for lower profits as they cannot raise prices in this global economic context," Sun Xi Min, Deputy Secretary of China's Textile Ministry, told Gulf News.

"A stronger yuan is certainly hurting our export-driven companies. The challenge lies in maintaining — and even improving — the quality of the goods that we export to the world, without charging our customers more," Sun said.

Since Beijing bowed to US and European demand to ‘float' the yuan (also known as the renminbi) last month instead of maintaining a defined peg to the dollar, the exchange rate has appreciated by about 0.75 per cent against the dollar.

Export footprint

"Any appreciation in the domestic currency will make our exports less competitive," Sun agreed. Chinese manufacturers will have to walk the fine line between increasing their profits and expanding their export footprint.

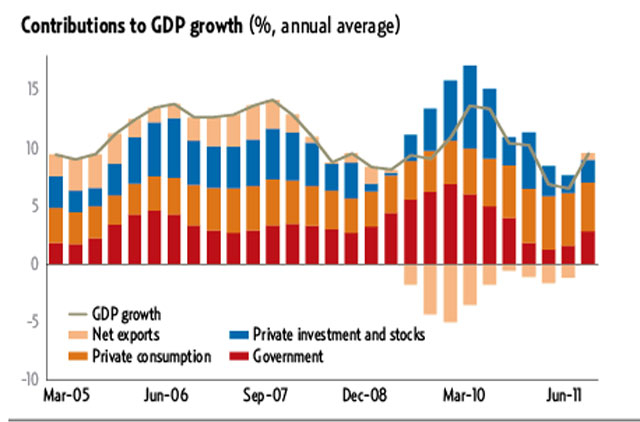

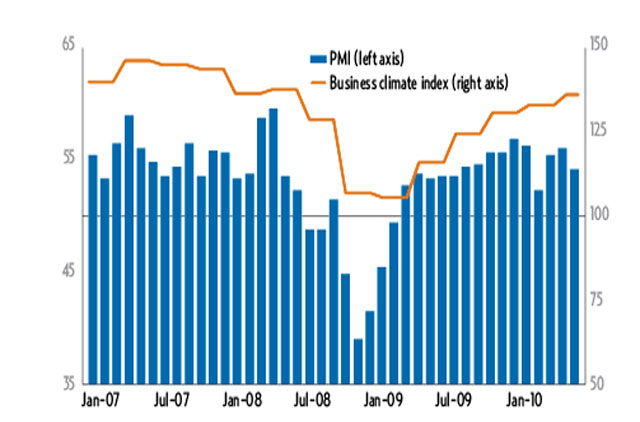

Latest data from the IMF indicate that that momentum is returning to the Chinese economy, with the gross domestic product (GDP) on track to reach double digits this year. Inflationary pressures are also abating.

The dragon may have been wounded, but it is recovering rapidly and still breathing fire.

Real GDP growth slowed to 10.25 per cent year-on-year in the second quarter of 2010, down from 11.9 per cent in the first quarter.

Higher investment and a rebound in net exports were the main drivers of growth in the second quarter. Consumer and producer price inflation eased in June as food and commodity price inflation slowed.

The trade surplus grew in June to $20 billion. As in May, export growth continued to outpace imports.

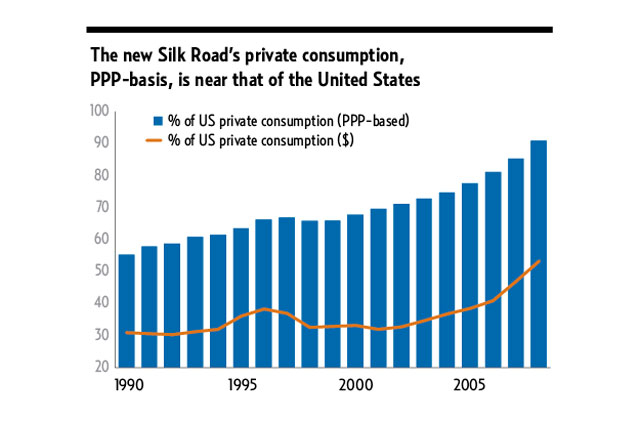

China's hunger for new export markets has analysts talking about the emergence of a new Silk Road. "The rise of a new Silk Road promises to be one of this century's greatest stories. This historic trade route stretches from China to the Middle East.

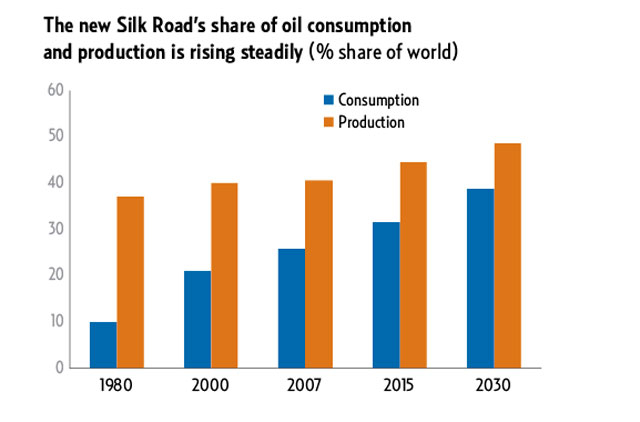

"It includes some of the world's largest oil producers and wealthiest investors," said Ben Simpfendorfer, the chief China economist for Royal Bank of Scotland and author of The New Silk Road.

Oil wealth

"[The road] is home to more than half of the world's population and the majority of its Islamic population," he said. Simpfendorfer's definition of the Silk Road includes emerging economies bound together by history, culture, geography — and trade.

"East Asia, Central Asia, South Asia, and the Middle East are all easy inclusions. However, I also include North Africa because of its Arab and Muslim heritage, and I exclude Japan because of its status as an industrialised economy," he said.

According to a research note Simpfendorfer wrote for RBS, the idea of a new Silk Road emphasises economic linkages, not just relative GDP growth rates.

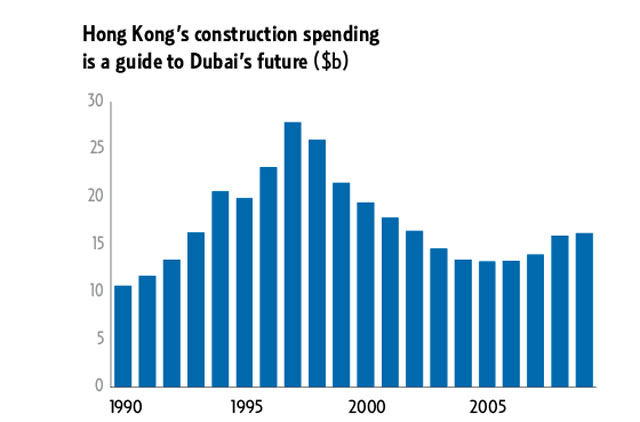

So, even if China's fiscal stimulus spending slows, Chinese railway companies can still make money building railways in Saudi Arabia and the UAE.

China has targeted an increase of 20 to 30 per cent in exports to the Middle East this year and will use Dubai as the hub to achieve this, Deputy Secretary Sun said.

Two-way trade between China and the Middle East has tripled in the last five years to $107 billion in 2009. With free trade talks under way between the Gulf nations and China, trade is set to more than triple to at least $350 billion by 2020, according to consultancy McKinsey.

"Export promotion has been a key pillar in China's development and growth strategy. This has led to large trade surpluses and significant foreign exchange reserves," said Dr Armen V. Papazian, chief executive of Keipr, a consultancy that specialises in business analytics and intelligence.

"As a response to the slowdown in global demand, a number of policy initiatives have gained momentum in China.

"The first one is the expansion of trade relationships and the deepening of alliances in different parts of the world. The Middle East has been a key region and will grow in importance in the new trade demographics.

"The second is the generous export credits that Chinese companies provide to their counterparts around the world. By making importing from China easy, by introducing deferred payments for foreign traders. China is supporting its export strategy with a credit strategy that is much needed in the current liquidity environment in key markets," Papazian said.

Sun told Gulf News China will invest Dh100 million in infrastructure in Dubai to manage the growing demand for products from just one of its provinces — the Ningxia Hui Autonomous Region.

The investment includes the establishment of a 200-square-metre sales complex and representative office near Al Maktoum Road in Deira.

Trade between the UAE and China could surpass $100 billion by 2015, according to Hassan Jarrar, head of wholesale banking for Standard Chartered in the UAE.

Most dominant

After hitting $28 billion in 2008, trade between the two countries dropped to $21 billion due to the economic downturn. But Jarrar told the Abu Dhabi and China Economic Forum in Shanghai last month there was reason to believe trade between the countries would rise significantly during the next five years.

India and China have become the most dominant exporters to the UAE, accounting for nearly a quarter of the country's total imports in 2009, according to official data.

India exported a record Dh61.5 billion worth of goods to the UAE in 2009, accounting for around 13.7 per cent of the country's total imports. China's exports to the UAE stood at Dh47.8 billion, constituting around 10.7 per cent of the country's total imports of Dh447.3 billion.

Together, the two nations exported Dh109.3 billion worth of goods to the UAE in 2009, nearly 24.5 per cent of the UAE's total imports, according to the Ministry of Economy. The US, which had maintained the second position in exports to the UAE in most previous years, retreated to third rank, with the value of its exports to the country totalling around Dh41.5 billion last year.

Cashmere Abayas and Halal food

A single province in China exported more than a billion yuan worth of cashmere products to the UK, US and Europe last year. And it plans to bring abayas made of the material to the UAE and the Middle East.

Apart from abayas and scarves made from the fine wool, the Ningxia province will also look at creating a market for halal foods in this region, Sun Xi Min, Deputy Secretary of China's Textile Ministry, told Gulf News.

American and European orders for garments made from cashmere wool, also called the "diamond fibre", fell by 30 per cent last year. According to a report in the New York Times, garments made of cashmere have become noticeably skimpy, using less of the costly material.

Ningxia is a predominantly Muslim province, Sun said, making halal food one of its natural exports. Other products include clothing, food and food supplements, cosmetics and household consumables, he said.

Are more people starting to trade with China? Is this trend becoming more popular? Why do you think so?