Bangalore: Asia, with its large migrant population, promises a huge growth market for US payment service firms, but for pure-play companies like Western Union and MoneyGram International, that's not the end.

They are busy looking for newer avenues ranging from domestic services to mobile transfers as they try and win more customer confidence, even though informal channels rampant in the region pose a big challenge.

That Asian countries are major recipients of remittances is no secret, but apart from inter-continental transfers, the domestic market within Asia, especially in the southeast, is also opening up as more people cross borders within the region for education and in search of jobs.

"We are increasingly seeing growth in outbound transactions within Asia-Pacific (APAC) as more Asians migrate within Asia," said Drina Yue, Western Union's senior vice president for Asia Pacific.

Western Union has already launched domestic transfer operations in the Philippines and Indonesia, while MoneyGram is looking at the region more closely. These companies also see opportunity in Malaysia — the largest sending market in Asia — home to a big population of Indonesians, Vietnamese and Bangladeshis.

Countries like India and China have been the top remittance receivers for some years now, but government regulations forbid the companies from operating on a domestic basis.

However, MoneyGram CEO Pamela Patsley said there is a great opportunity in the money transfer market within Indian states.

"Today we are not allowed to do that but [it] may become an important aspect going forward," Patsley said.

If it becomes a reality, the companies may find some competition from banks' online money transfer that come at no cost. But they are also targeting a vast number of people who don't have bank accounts.

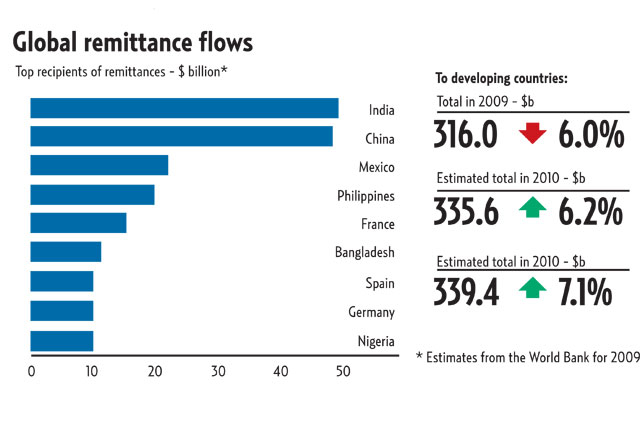

The World Bank report also forecast remittance flows to developing countries to rise by 6.2 per cent in 2010 and 7.1 per cent in 2011, led by Asia. They dropped 6 per cent to $316 billion in 2009.

Informal channels

As they tap the APAC region, money transfer companies not only have to fight themselves, but also against informal transfer systems that have their own loyal followers.

Money transfer companies have a widespread network across the world, but higher fees and lesser paper work tend to encourage flow of money through informal channels like hawala network, World Bank's lead economist Dilip Ratha told Reuters.

"If you want to send money to a village in Pakistan, it is very difficult to find formal operators who can do that, whereas Hawala dealers can find ways to make that happen," World Bank's Ratha said.

Hawala, a system largely based on word of mouth and honour, tends to bypass legal scrutiny as no formal documents are required, and the system has been often accused of channelling illicit money and funding insurgency in some cases.

"That's a huge white space on the paper, all the informal channels," MoneyGram's Patsley said.

The companies are in talks with governments to look for ways to provide a viable alternative to Hawala, which has been defined as "money transfer without money movement" by Interpol, the international police agency.

"We want to show them [governments] that allowing companies like Western Union to provide easy access; time convenient service is the best way to combat informal channels," Patsley said.

Going mobile

Money transfers are set to see a jump as global markets find their feet and once-stagnated job markets open up.

"There is a lot of fish out there in the pond and all we need to do is to cast the net out wide," Western Union's Yue said.

The World Bank estimated that APAC represents about 20 per cent of $317 billion in global remittances. APAC is about 9 per cent of Western Union's total revenue as of the first quarter of 2010. "So, it tells us that there is an opportunity that we can capture," Yue said.

To provide more people-friendly services, both Western Union and MoneyGram have launched mobile money transfer option in the Philippines as a pilot project.

Despite a small population when compared with China and India, the Philippines is one of the top global remittance receivers. In the Philippines, the usage of mobile phones as a mode of payment device is well established, according to MoneyGram.

Whether offering new services or taking the technology route, it only shows the growing interest of the money transfer giants to reap the benefits of the huge migrating population in Asia.