Dubai : Advertising declined in the UAE between 2 and 18 percent in the first quarter of 2010, with newspaper being hit particularly hard, according to regional analysts.

Advertising expenditure declined five per cent to $337 million (Dh1.2 billion), but the UAE remains the second biggest advertising market in the region with a 12 per cent share after Egypt, according to the latest report by the Pan Arab Research Centre (PARC).

The UAE led in the GCC with 32.7 per cent of newspaper advertising space and advertising spending of Dh1.3 billion last year, despite a fall of 27 per cent in advertising spending in 2009, due primarily to the plunge in real estate advertisements.

But despite the stabilisation of advertising spending in the UAE, newspapers still fell behind.

Newspaper advertising spending in the first quarter fell two per cent according to PARC and 18 per cent according to international market research company Ipsos MediaCT.

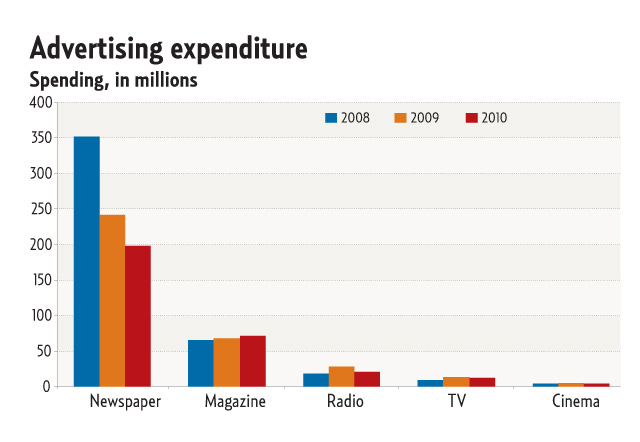

Though newspapers had the largest share of advertisements compared to other media, their slice of the pie shrank steadily in the first quarter of the last three years with 65 per cent in 2010, 68 per cent in 2009, and 78 per cent in 2008, according to Ipsos.

Industry insiders were not surprised that the UAE leads advertising spending in the GCC.

Fragmented

"The population is more fragmented in the UAE than in other countries, that is, you need to use more titles to reach your target audience," said Gassan Harfouche, Treasurer of the UAE chapter of the International Advertising Association.

"The UAE market is also driven more towards tactical activities rather than brand-building activities," Harfouche added.

Another reason is "simply the UAE has become the most active advertising market in the GCC," according to Ramzi Ra'ad, Chairman and chief executive officer of TBWA/RAAD, the Dubai-based advertising agency network.

The focus on advertising in newspapers in the UAE, as opposed to other media, seemed the natural choice.

The UAE has been an active trading hub since the beginning of its modern history, attracting multinational companies to establish regional offices and warehouses here and this attracted buyers, leading to modern development and the flourishing of the retail sector, Ra'ad said.

The combination of retail and local developers' advertising, as well as the superior quality of newspaper production in the UAE, led the focus of advertising towards newspapers, he said.

"It is important to keep in mind here that preparing advertising material for TV could be an expensive investment which many national companies cannot afford, so they use newspaper advertising because they can afford generating good quality material in addition to its attractive editorial content, sophisticated production quality and its wide reach to a broad spectrum of readers."

Elie Aoun, managing director of Ipsos Mena, also noted that readership in the UAE is "very high" compared to other countries in the region and local advertisers use it as a platform to reach local consumers.

Newspapers, which have been struggling for years to find sustainable ways to remain profitable amid the rise of online editions, are feeling the impact of declining advertising.

Most affected media

"One of the most affected media in the region due to the economic crisis is newspapers; we estimated the drop [in advertising spend) between 2008 and 2009 to be 31 per cent," Aoun said.

"Newspapers [which] don't have any revenues from the government or other sources and which only depend on their [advertising] revenues will surely struggle more." Real estate adverts, which formed the bulk of newspaper advertisements and revenue in the pre-crisis period, fell 43 per cent last year, according to PARC reports.

"Because top spenders on local newspapers were the real estate companies, and we all know what happened in the real estate business, some companies had to cut their budgets and some even vanished," Aoun noted.

Many magazines and other publications did not have sustainable business models that functioned to serve their readership and which were dependent on the boom in real estate advertising quickly disappeared during the crisis.

Without the adverts, they had little competitive edge to rely on for survival.

Magazine advertising spending fell 3 per cent and accounted for 12 per cent of total spending at $40 million, according to PARC figures.

However, Ipsos reported an increase of 4.5 per cent over the first quarter of 2009 and advertising shares increased in small increments in the first quarters of the last three years.

PARC reports that tele-vision ad spending plunged 28 per cent after having braced a challenging 2009 with no decline and now claims a share of 9 per cent of advertising spending in the UAE.

On the regional level, ad vertising spending increased 21 per cent in the GCC, Levant, and pan-Arab media markets in the first quarter of 2010, said the PARC report. Egypt is leading with a $340 million share followed closely by the UAE at $337 million.

Television claims 55 per cent of the regional market and is set to increase during Ramadan, when the region's 400-plus free-to-air channels broadcast popular Arabic TV dramas.

During Ramadan last year, advertising spending reached $11.6 million — the highest monthly amount for that year, according to Ipsos figures.

Mixed responses

Industry commentators had mixed responses to the future advertising trends in the UAE and the region.

"Our ad market will definitely continue to grow across the whole of Mena because we are the heart of a growing economic region and because our advertising market is developing out of a very low base," said Ra'ad.

"Media rates had grossly cheapened the importance of our media consumers at the very beginning and since then we have been running a fast catch-up race," he added.

Media will continue to grow, Ra'ad said, but he emphasised that digital media represented only 1 per cent of the total spend in the region in 2008. Globally, it was 10.2 per cent and is anticipated to become 80 per cent by 2020.

"Surely the Mena advertising market will follow this trend but at a distance," he predicted.

PARC analysts gave a more cautious account, who estimated that short term ad spending will fluctuate in the first half of 2010 and could to face stalled growth. By the second half double digit growth could return, according to PARC product manager Shaharyar Umar.

Top picks

- The top five advertisers by industry in the media in the first quarter of 2010 were the government and organisations; and shopping malls and retail stores which have replaced real estate spenders in second place. The entertainment sector is in third place; insurance, real estate, and properties in fourth; and in fifth place the publishing media, according to PARC.

- The top five advertising spenders by brand in newspapers for 2010 were Du, Carrefour, etisalat, Lulu and Toyota, according to PARC reports.

- In magazines the top advertising spenders for 2010 were Home Centre, Splash, Visa, Damas, and etisalat, according to PARC.

— D.K.Y.