Dubai: The first week of December will see a highly anticipated meeting charting a new roadmap for trade ties between the GCC and Africa with the Council of Saudi Chambers and the UAE-based Gulf Research Centre jointly organising the Africa Investment Forum 2010 in Riyadh.

The importance of the conclave — to be held over two days starting December 4 — for the UAE was outlined by Shaikh Abdullah Bin Zayed Al Nahyan, Minister of Foreign Affairs, when he observed that "the forum would provide constructive ideas and practical initiatives for how to strengthen relations between the Arabian Gulf and the African continent".

Being an emerging investment destination with huge untapped economic potential, Africa has become increasingly important for the GCC. However, currently, Gulf-Africa relations remain highly asymmetrical and confined to a limited pattern of econ-omic exchanges, the organisers say, pointing to "the outstanding potential for augmenting economic cooperation between the two regions for mutual prosperity".

Investment environment

The conference will focus on the investment environment in Africa, bilateral trade and trade financing, agriculture, minerals and natural resources, energy, telecommunications and infrastructure as well as tourism.

The main purpose of the forum is "to create opportunities to network and establish working opportunities as the institutional relations between the GCC states and Africa are still in their infancy". This includes existing and emerging economic sectors about which there is little information available or which have not been widely publicised.

The conference will be attended by the presidents of Mozambique, Angola, Benin, Zambia, Kenya, Senegal and Ghana and several ministers and senior officials from other countries, including South Africa.

The GCC countries have maintained close economic ties with African countries in recent years. The UAE, in particular, already has some investments in eastern, southern and northern African countries and is planning to expand its reach.

The Riyadh Forum is not the only high-level meeting that focuses on Arab-African economic cooperation. In May this year, the Dubai Chamber of Commerce and Industry hosted a workshop on the fourth Common Market for Eastern and Southern Africa (Comesa) Investment Forum which is scheduled to be held in Dubai next year.

Considered the largest economic bloc of African countries, Comesa — whose 19 member states are Burundi, Comoros, the Democratic Republic of Congo, Djibouti, Egypt, Eritrea, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia and Zimbabwe — is a market that will build up to an estimated 500 million consumers by 2015.

"This provides unparalleled opportunities for investors from all over the world," Hamad Bu Amim, Director General of the Dubai Chamber, told the forum. Currently, the Comesa region has a population of more than 389 million and a total GDP of over $230 billion (Dh844 billion). The region's annual imports are put at $32 billion and exports at $82 billion.

According to Shaikha Lubna Al Qasimi, Minister of Foreign Trade, the UAE seeks to cooperate with African countries on tourism, infrastructure, oil, gas, mining, energy, transport, logistics, ports services and the IT and mobile phones sector.

UAE's top players

One of the major investors is Dubai World with some 30 investment projects, among them marine terminals in Djibouti, Algeria, Dakar (Senegal) and Maputo (Mozambique) and wildlife reserves in Rwanda and South Africa as well as a hotel project on the Comoros Islands. Etisalat has stakes in several African telecom companies covering Sudan, Tanzania, Benin, Burkina Faso, Togo, Niger, the Central African Republic, Gabon and Ivory Coast. Dubai Investments holds a stake in Tunisie Telecom. Other target countries are Zambia, Lesotho, Zimbabwe and Malawi and the Maghreb countries.

Trade relations are supported by the Africa-Arab Business Investment Forum that brings together business leaders and government institutions from Africa, the GCC countries and international institutions to discuss and explore investment opportunities. The organisation held a conference as recently as November 17 in Dubai.

"The UAE has maintained close economic and commercial ties with Africa," Shaikha Lubna said. "From a business perspective, the proximity of our region with the continent makes it a more convenient partner compared to Western companies."

She pointed out that the UAE has reached Dh70 billion in non-oil trade with Africa, which underlines its commitment to closer regional and international relations.

According to recently released data from the ministry, the overall trade of the UAE with six non-Arab African countries reached Dh204.14 billion in 2009. The six countries are Angola, Kenya, Nigeria, Ethiopia, South Africa and Tanzania. The most important trading partner is South Africa. However, trade with the country dropped last year to Dh3.22 billion compared to Dh13.94 billion in 2008, down 77 per cent.

Growing partnership

In contrast, the UAE's trade with Nigeria staged the biggest increase among the six nations, doubling to Dh3.15 billion in 2009 from Dh1.57 billion the previous year. Trade with Tanzania also rose sharply last year to Dh3.17 billion compared to Dh1.87 billion in 2008. With Kenya, the total trade rose to Dh2.11 billion in 2009 from Dh1.83 billion in 2008.

Trade between the UAE and Angola declined last year to Dh1.29 billion compared to Dh3.12 billion the previous year.

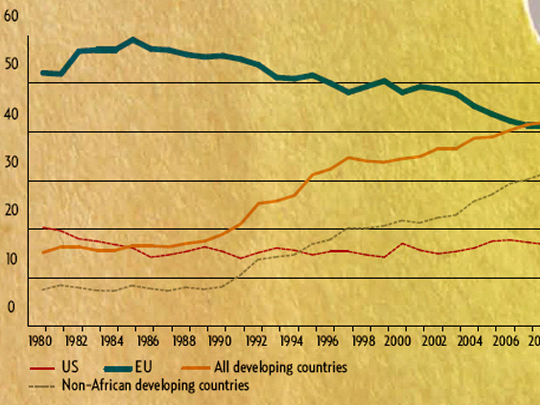

Africa currently has trade deficits with Saudi Arabia and the UAE. In contrast to its trade with developing countries, Africa's recent trade with the developed countries has been characterised by faster growth in exports than in imports, according to the report released by the United Nations titled ‘Economic development in Africa 2010'.

The UAE is a more important trade partner for most African countries than the current figures suggest, the UN says. It is one of the top 10 export markets for nine African countries in spite of its imports from Africa being only about half as much as Brazil's in value terms.

The Arab countries have historically been active in infrastructure finance in the region. However, unlike China and India, they channel their support through special funds or development agencies such as the Islamic Development Bank, the Arab Fund for Economic Development in Africa, the Kuwait Fund for Arab Economic Development, the Opec Fund and the Saudi Fund.

It is estimated that on an annual average basis, the Arab countries provided $500 million in infrastructure finance to sub-Saharan Africa over the period 2001-2007.

About 50 per cent of support by Arab countries for infrastructure development goes to transportation, 30 per cent to power and 15 per cent to water and sanitation.

Without foreign investments the African continent will not be able to tap into the global value chains, says World Bank economist Harry G. Broadman. But he also mentions that the African governments must enact a series of reforms of basic institutions, regulations, infrastructure and tariffs, to realise the benefits.

Baldwin Berges, managing director of London-based investment house Silk Invest, does not rule out that some African nations can tackle this challenge.

For example, he compares Nigeria to Brazil, as it has "a similar amount of people, abundant resources, an increasingly functional democracy and a well-regulated financial system".

Brazil has made a total turnaround from being a largely dysfunctional country well into the 1990s, he reckons. "A true example of how perception lags reality!"

Strong foundation

Africa has a long history of interaction with the Arab world. However, a formal framework for cooperation between both groups did not exist until March 1977 when African and Arab kings and heads of state and governments held the first summit in Cairo to define principles and collective actions needed to further intensify ties between the two groups.

At the summit, leaders of both groups agreed to collaborate on political issues and diplomacy, economic and financial issues, education, culture, science and technology, information, and commerce. They also created various structures and institutions to support the relationship. These include the Joint Ministerial Council, the Standing Committee of Afro-Arab Cooperation and the Ad Hoc Court for Commission of Conciliation and Arbitration.

Some progress has been made in Afro-Arab cooperation since the 1977 Summit. For example, there has been more cooperation in trade and culture as evidenced by the regular organisation of Afro-Arab trade fairs and the establishment of the Afro-Arab Cultural Institute in Bamako.

Despite these achievements, there is an acknowledgement by both parties that the existing level and scope of cooperation between them is low given their geographical proximity as well as their historic and cultural ties. In an effort to address this issue, leaders of African and Arab countries met in Libya in October to revitalise their cooperation and map out a plan of action for future engagements.

The Gulf countries have also intensified efforts to boost political and economic cooperation with Africa. Last February, the Gulf Research Centre organised the first Gulf-Africa Strategy Forum in Cape Town, South Africa. The conference provided an opportunity for governments, academics and the private sector to discuss the state of cooperation between the Gulf States and Africa and offer recommendations on how to strengthen partnership. The conference is expected to be organised annually.

Source: Economic Development in Africa Report 2010