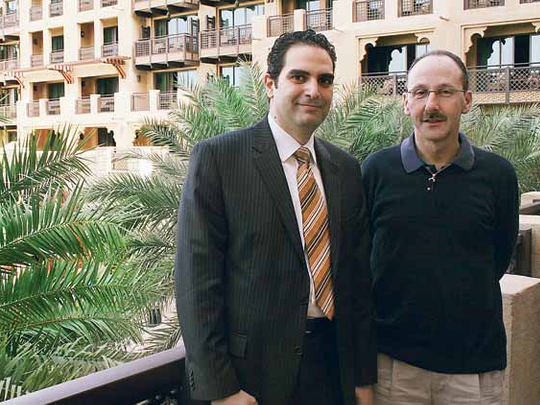

Dubai: The global financial crisis and its impact on the Middle East has been a wake-up call for the region, said Alan Bloom, global head of restructuring auditing and financial advisory giant Ernst & Young.

As businesses in the region currently face liquidity issues, they need to become more transparent to encourage banks to resume lending and stakeholders to regain confidence, Bloom said.

"If I had a wish, it is that companies took advice earlier," he told Gulf News in an interview in Dubai yesterday. "This is not a sign of weakness, but of strength, and stakeholders appreciate it."

Bloom is referring to the lack of transparency which is a phenomenon especially among family businesses in the Middle East: "Now, in view of the liquidity squeeze, if you want support from your stakeholders, you need transparency. This is the price for support."

End of an era

The region, adds Hani Bishara, Ernst & Young's head of restructuring for the Middle East, is characterised by family businesses and large conglomerates. "The era of name-lending has come to an end," he says, hinting at the Saad/Algosaibi case in Saudi Arabia. "Now it is all about a proper organisation, a proper business model, corporate governance and an optimisation of assets and resources. But still, some companies are more open to transparency than others."

It isn't the case that money completely dried up in the wake of the financial crisis, says Bloom. "There is a lot of money in the world to put to work, a lot of liquidity around," he adds. "Just look at the sovereign wealth funds, not only in the Middle East, but also in China and elsewhere. Although there is a lot of equity around, it needs to attract debt and the debt markets are still tough."

In the Gulf and elsewhere, people have learnt their lessons, and in a period of two to three years things will be overcome, he argues.

"In the new world order, the long-term vision of the Middle East countries to diversify their economies is the right strategy," Bloom said. "The Middle East must play a big role, for example as a financial centre, with different business models than China or India."

The correction in the Gulf countries is temporary, Bloom said. "No place in the world has been immune to the meltdown. But the region has enough strength and vision. Of course it needs the support of equity and debt."

Even the decline of the property market in Dubai "is nothing special," according to Bloom. "That is what happens in fast growing markets. It is inevitable that there is a correction, and there are even wider swings in emerging markets."

"The question is: Is it manageable? I think it is," adds Bishara.

Concerning Dubai World, Bloom says, according to publicly available information about the case, he awaits a timeframe of "a couple of months" for a debt restructuring proposal. "It's a huge and complex case, but I cannot comment on it as Ernst & Young is the auditor."

Weak fail, strong survive

In the aftermath of the global financial meltdown, there will be one rule, according to Ernst & Young's global head of restructuring Alan Bloom: "The weak will fail, the strong will survive."

Bloom explains: "During the recession, good companies have used the time to control their balance sheets. The result is that key players and top companies in every sector have become stronger than before. The non-leveraged world is in a good position."

But still, not everyone believes that the world has reached the end of the crisis. Bailouts by governments have been absolutely necessary, said Bloom, but there have also been bailouts of firms that were seen as "too big to fail."

"There has been artificial support for a lot of those companies," said Bloom. So he thinks that in 2010 and 2011 there will still be significant restructuring problems.

"People tend to think that most problems occur during a recession — but most of it comes afterwards," Bloom said.

The period between 1997 and 2007 was the private equity phase. "I would not say that this era is over, but strong companies are now in a much better position [to acquire on their own], just look at the Kraft-Cadbury takeover."