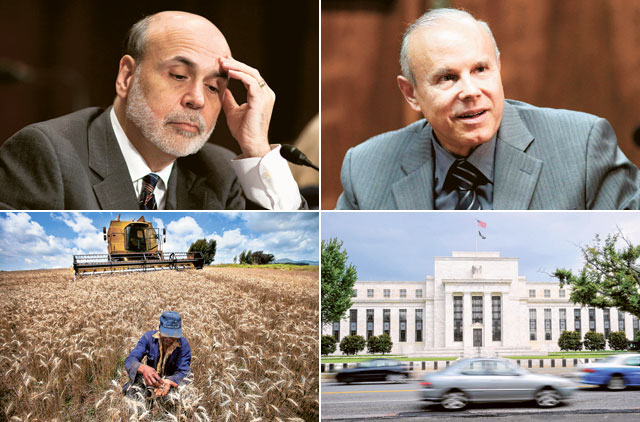

Dubai: All eyes will be focused on Federal Reserve Chairman Ben Bernanke when he speaks on Friday at the annual gathering of global central bankers in Jackson Hole, Wyoming.

The unconventional monetary policies of the Fed over the last few years have almost hooked the financial markets to frequent liquidity pump priming and market operators expect the final redemption to come from the central bank when the economy and markets hit the wall.

By its own admission the Fed has recognised the current economic conditions are far from ideal. Last week the Federal Open Market Committee (FOMC) significantly downgraded its outlook for the US economy. Aware of the fragility of market sentiment, the Fed issued explicit forward guidance on interest rates.

On August 11 the FOMC pledged to keep the Fed funds rate at its current level until at least mid-2013. The Fed cut interest rates to their current target range of 0 to 0.25 per cent in December 2008.

Although the Fed stopped short of offering a sequel to the $600 billion (Dh2.2 trillion) QE2 (the second tranche of quantitative easing) stimulus programme that was wound up in June this year, it promised to further review other ‘available tools' to boost a slowing economy.

Limiting metldown

And by suggesting further easing, the FOMC helped to limit a potential meltdown in the global financial markets. Likewise, the ECB decision to buy Italian and Spanish sovereign debt reversed the trajectory of rising yields.

Despite such unprecedented action by the central banks the US and European markets have been on a roller coaster on rising fear of the downside risk of both the US and Eurozone economies sliding into recession.

While economists and strategists argue that the immediate concern of central banks should be preventing economies from a potential double-dip recession, there are an equal number of voices arguing that the Fed has already exhausted monetary policy options and any further easing would lead to inflationary spiral culminating in some sort of entrenched stagflation.

"We think the ECB and the Fed should continue to focus on downside risks. The risks of the major economies drifting into deflation — and the consequences to the economy — greatly outweigh the risks of unacceptable inflation," Ethan S. Harris, North American Economist of Bank of America Merrill Lynch, wrote in a note this week.

Economists favouring quantitative easing believe expanding the central bank's balance sheet can stimulate growth as long as the bank has credibility.

"We expect the Fed to heed the lesson, implementing a passive version of ‘operation twist' within the next few months," said Gustavo Reis an economist with BofA Merrill Lynch.

Weak economic data

While the US economy has taken a turn for the worse — growth ground to a halt in the second quarter and nearly flat-lined in the first — there's a sense the Fed will want to wait a bit longer to assess the impact of its past stimulus.

Recent data suggests the US economy is in very similar shape to where it was at the August 2010 Jackson Hole meeting. Unemployment is still high, the housing market has not recovered, consumer and investor confidence are both low, and second quarter growth was lower than first quarter growth — under two per cent.

Those were the same conditions that eventually led Fed chairman Ben Bernanke to announce QE2 in November 2010. New US home sales in July fell to their lowest level in five months, dampening hopes for any rebound in the dismal housing market, one of the key factors that may drag the country into a double-dip recession.

Against the backdrop of global economic uncertainty, new home sales dipped 0.7 per cent to an adjusted annual rate of 298,000 in July, the lowest since February. The numbers, which fell for a third straight month, came in below analysts expectations of 310,000.

"The continued weakness in new home sales remains an ever present reminder that the US housing market has not turned around and there is really very little reason to think this will end any time soon," said David Semmens, US economist at Standard Chartered.

Weak employment data has further dampened the housing market outlook. "We really need to see traction in the labour market. The pockets of strength are very localised but the overall picture remains very downbeat," he added.

The recent turbulence in financial markets, US debt crisis and the stalling economy have all raised fears of another recession. All these issues together are likely to apply pressure on the Fed to go for another round of QE.

Balancing act

As the market expectations build up, Fed policymakers have sought to downplay expectations of an imminent QE3 announcement. The appetite within the Fed for another big round of so-called QE3 — another bond purchase programme in the hundreds of billions of dollars — is low. St Louis Fed President James Bullard was quoted in Japan's Nikkei newspaper as saying while the Fed could buy more bonds if the economy weakened, the time was not right for such a move.

Given the political wrangling on spending, it is almost an impossibility to get any kind of fiscal stimulus passed through the Congress. Analysts say the scenario is very similar to a year ago at this same conference, when Bernanke promised to use all the weapons the Fed had available to rescue the economy. A few months later, the Fed began its $600 billion asset-purchase programme intended to stimulate growth.

Like all other central banks of the world the Fed has the dual mandate of economic growth and stable prices; even if Fed policymakers believe further easing might help economic growth and employment, they may be reluctant to compromise the other half of their mandate.

Analysts who do not expect an imminent monetary easing say Fed leaders view the current signs of econ-omic weakness differently from how they viewed the economy this time a year ago and want to see more evidence before making their next move.

"[Bernanke] will explain what the Fed has done and the costs and benefits of its remaining policy options," Michael Feroli, chief US economist at J.P. Morgan Chase, said in a research note.

Quantitative easing is supposed to help lending (and thereby growth) by pushing down long-term interest rates, which are already quite low. It is not clear that lowering them further would do much to encourage lending, especially since many companies do not see a need to borrow primarily because demand is so weak and not because credit is expensive.

The other way quantitative easing is intended to help spur growth is by encouraging investment in riskier assets, like stocks, because the return is so low on long-term Treasurys. If investors flee to these asset classes that could raise the price of these assets, causing consumers to feel richer and so more comfortable with more spending.