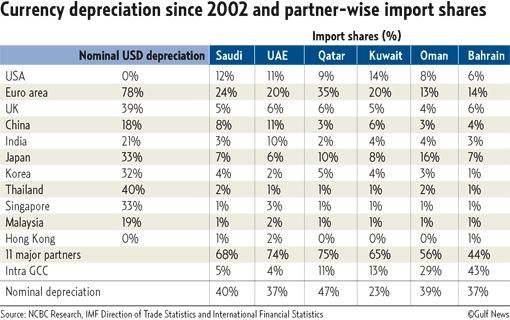

Dubai: The UAE dirham depreciated 37 per cent against a basket of 11 currencies of the GCC's leading trading partners in the past five years.

All other Gulf currencies with the exception of the Kuwaiti dinar also declined by 37 to 47 per cent. The Kuwaiti dinar, which was de-linked from the dollar and pegged against an undisclosed basket of currencies last May, depreciated 23 per cent in the same period, according to an estimate by NCB Capital, a Saudi Arabia-based investment bank.

The currency depreciation effectively means higher imported inflation in the region, adding to the overall inflation caused by factors such as supply shortages and surging demand due to the regional economic boom.

While currency flexibility enabled Kuwait to limit effective depreciation substantially, according to NCB Capital's estimates the Saudi riyal, UAE dirham and Qatari riyal have depreciated 40 per cent, 37 per cent and 47 per cent respectively in nominal terms and the dollar declined 78 per cent against the euro and 40 per cent against sterling.

Do you think this trend will continue or is it a short term phenomenon? Are you planning to switch your savings to a different currency?

Your comments

The depreciation of the US currency can also be attributed to the ongoing Middle East war crisis, which is leading to a hike in oil-price by OPEC, tighter IMPEX regulations, expensive logistics, and a feel of insecurity in large investors. Perhaps these factors are more prevailing over the weakening US currency than the usual international trade factors. Therefore, the crisis is likely to last longer than that caused by the usual economic ups.

Nasir

Dubai,UAE

Posted: April 08, 2008, 13:27

I urge and BEG the central bank to break the UAE Dirham from the $ peg ASAP

Wosim

Dubai,UAE

Posted: April 08, 2008, 12:14

Yes, this will continue until the unified currency come in to force.

Vittal

sharjah,U.A.E

Posted: April 08, 2008, 12:07

I think this trend will continue and the UAE Dirham will depreciate even further, as the currency is pegged to the US Dollar and as per analysis, the US economy is already in recession. It is said that normally a recession period can extent up to 13 months. So until then, I don't think there will be any improvement in the US Dollar nor the UAE Dirham, infact it would get worse.

Faizal

Dubai,UAE

Posted: April 08, 2008, 09:54

I think the trend will continue and all the indicators so far says the same. By keeping the peg, GCC countries are creating a big problem for thenselves as well as for the people living here. The view point is that the peg is healthy for the incoming investment as the region is attractive for the investment coming from the stronger currencies, but at the same time it is creating an adverse effect inside the country. The example of Kuwait is infront of us the de-pegged the $ and they are better off among other GCC currencies.

Muhammad

Ajman,UAE

Posted: April 08, 2008, 09:35

I feel that this trend is likely to continue since the dollar is depreciating and it seems the trend is not going to change in the near future, especially with subprime crisis causing a severe recession in US. Because of this, all Gulf currencies pegged to the dollar will continue to depreciate causing huge inflation in this region, leading to expats going back which translates into a loss of skilled labour and manpower, which will further bring down the Gulf Economies. It is essential the Gulf economies depeg their currencies from the dollar to sustain themselves.

Saveena

Dubai,UAE

Posted: April 08, 2008, 08:51

Short term Phenomenon? Is 6 years short term? NO.

GCC states should do something now.

Lubomir

Dubai,UAE

Posted: April 08, 2008, 01:17