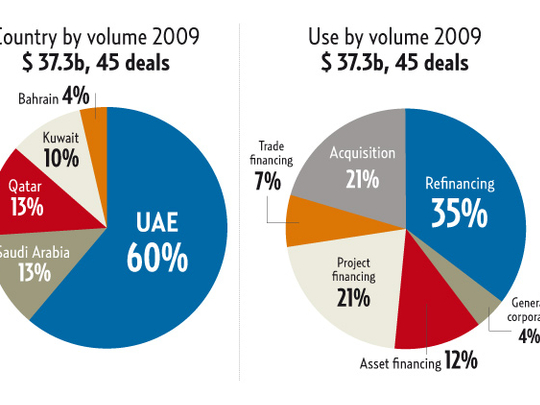

Dubai: Despite the huge funding requirements and strong signs of revival in the Gulf debt markets during the first three quarters of 2009, bankers expect a slow recovery across the spectrum in the debt issuance market in the Gulf and wider Middle East.

Bankers and analysts expect the markets to remain tough for corporate issuers for the next 12 to 18 months. "There is more than $100 billion (Dh367 billion) worth of refinancing requirements in the region over the next two years. The refinancing demand in 2011 is worth more than $41 billion," said Julian Van Kan, Global Head of Loan Syndication and Trading.

Recent issues from the region show that in the syndication market is open for the quasi-sovereign corporates but still needs to be tested for non-sovereign borrowers.

Syndicated loan market

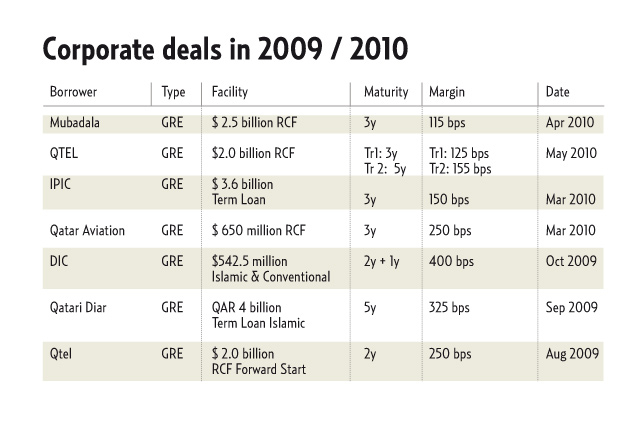

Momentum in the GCC syndicated loan market is clearly building up given the large oversubscriptions that were witnessed in some of the recent syndicated deals such as Mubadala's $2.5 billion deal in April, Qatar Aviation's $650 million three-year issue in March and Qatar Telecom's $2 billion issue in May.

In the case of Qtel issue, prior to the general syndication phase, the issue secured the support of some 14 relationship banks, raising a record $2.75 billion in commitments despite ongoing volatility in global financial markets. In the general syndication phase, an additional 17 banks joined with commitments of $1.11 billion, securing a total subscribed amount of $3.86 billion.

Analysts said the international interest in the credit facility — the first syndicated loan deal with a five-year tenor tranche for a GCC entity since 2008 — reflects return of confidence in the long-term prospects of regional corporates but this is largely limited to government related entities (GREs) and quasi sovereigns.

For the near term, bankers said availability of funding will not be a big problem but do not expect much variance in pricing from the current levels.

"We expect the pricing has reached a floor reflecting increasing cost of funding for banks. However, 5-year money is now available for GREs," said Van Kan.

Non-sovereign borrowers are expected to face several hurdles in the syndication market. Shortage of liquidity in the regional banking market, the large upcoming refinancing requirements, the high cost of funds in the international markets and the relatively weak governance standards are some of the major challenges the corporate sector is expected to face in the medium term.

A key challenge relates to low level of confidence in the region's corporate sector.

"Banks are hesitant to lend to firms lacking established track records of credit worthiness. Banks are also vetting with greater caution loan requests of long-standing family businesses as they rethink relationship lending policies after debt troubles surfaced among two such conglomerates in 2009," said John Sfakianakis, chief economist at Riyadh-based Banque Saudi Fransi.

Participation of regional banks in recent syndication deals shows a declining trend reflecting pressure on their liquidity. In the context of huge refinancing requirements in the region (estimated at $41 billion for 2011) many regional banks will need to replenish liquidity through longer term maturities and extend their debt profiles through bond and loan markets.

Bankers believe the sovereign debt crisis in Europe is likely to have a knock on effect on the cost of dollar funding requirements of both regional banks and corporates in the region.

Following the recent events in southern Europe, the spread of 3-month Libor (London interbank offered rate) over the dollar overnight index swap (OIS) has been widening. Analysts say this could impact the banks' cost of funds and liquidity, ultimately resulting in higher funding costs for companies in the region.

Popular interests

In the context of constrained bank lending and slow pace of recovery in both syndication and bond issues for the corporate sector in the region, project bonds are emerging a new instrument with huge potential, Peter Turney, Director Bond Organization - Middle East of BNP Paribas told Gulf News.

"Historically the market for project bonds was overshadowed by the bank lending market. Today with severe constraints in the bank market due to liquidity issues and high costs, project bonds are becoming popular, particularly among government infrastructure and mega projects," said Turney.

Project bonds are able to raise funds at relatively long dated tenors and attractive pricing is available due to stable and predictable cashflow generation capabilities of infrastructure and energy related sectors. While project bond is an important additional source of liquidity with strong investor demand, as an asset class it provides comprehensive security, portfolio diversification and is pre-vetted by lending banks, making them attractive to institutional investors..