As consumers in the UAE are spending an increasing amount of time on the Internet, driven in part by the high uptake of smartphones and tablet PCs, banks are rethinking the way they do business.

More financial institutions in the country are placing their bets on online banking, rolling out a number of strategies geared towards reducing branch visits and reducing operational costs, and enabling customers to save time.

Analysts have said that the uptake of online banking in the region is quite low compared to other markets, but the shifting demographics and consumer profiles indicate that the retail banking landscape will soon change.

Some banks are now developing initiatives to encourage online banking, investing in new digital technologies and apps, and upgrading their online tools that make it more convenient for retail customers to do a wide array of banking activities without walking into a branch.

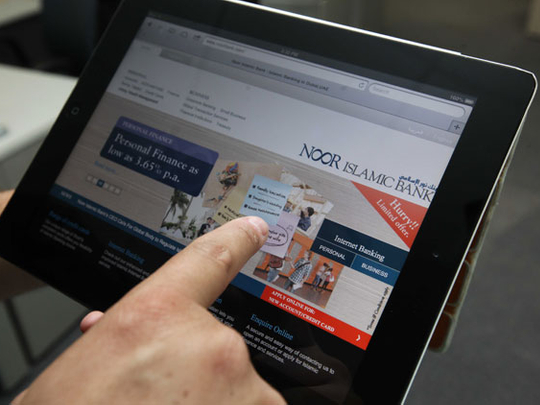

The latest to tap into the digital boom is Noor Islamic Bank, which has equipped six of its branches in the UAE with 15 Apple iPads, in the hope of encouraging its clients to bank online.

The bank has trained its staff to explain Noor’s online and mobile banking services and to demonstrate both services to the customers. It has also launched two special offers — free bank account opening without a balance requirement and five per cent cash back with credit cards applied online.

“We believe that our future customers will want to bank with us when they want, where they want and how they want. Digital banking is the future,” said John Chang, head of retail banking at Noor.

HSBC is planning to expand its digital channel and online banking services to include upgrades to their Android and Tablet offerings. The bank upgraded earlier this year its investment platform and launched the Client Wealth Dashboard in the UAE, allowing wealth management customers to view their entire investment portfolios online.

Emirates NBD has also tasked a dedicated team to manage “multichannel customer behaviour”, and instituted marketing routines to register customers for digital banking and enable them to activate their accounts.

Mashreq, for its part, has made it easy for its customers to open accounts and pay their bills online. The bank also allows customers to send money from the comfort of their home or office.

According to recent A.T. Kearney report, only about a third of all bank customers in GCC have so far signed up for online services, and only half of those (18 per cent of total customers) are active online.

In contrast, the uptake of online banking in developed markets averages around 50 per cent and surges to approximately 70 per cent in areas like Japan, Korea, Canada and Scandinavia.

“Despite the relatively low penetration of online banking in Mena, the demographics of the region’s Internet users and the growth in the number of people online suggests that this will change,” said Francesca McDonagh, HSBC regional head of retail banking and wealth management for Middle East and North Africa.

-----------------------

Rise in the number of online transactions

By Cleofe Maceda

Senior Reporter

With more financial institutions giving more impetus on e-banking, UAE banks are seeing a rise in the number of online transactions and customers.

Mashreq reported that online customer registration has increased by 145 per cent year on year. In a month, more than a million of transactions are done online. “We will continue to witness such growth since we are investing in state-of-the-art technology,” said Aref Al Ramli, head of electronic business and innovation at Mashreq.

Emirates NBD noticed a similar trend, citing that the number of active customers using its online and mobile banking platforms has increased by 65 per cent in the last 18 months.

“While more than two-thirds of the bank’s retail customer base is registered for online banking, we now have reached 26 per cent active online customer penetration in terms of the total retail base,” said Suvo Sarkar, general manager for retail banking at Emirates NBD.

HSBC noted that more than 31,000 customers log in to its Personal Internet Banking in Middle East and North Africa (Mena) every day and over 11 million logons are expected this year. Additionally, more than 50,000 HSBC applications have been downloaded across Mena on smartphones and tablets since the launch of its mobile banking platform.