Abu Dhabi : Dubai World's debt restructuring offer surpassed expectations of the Ministry of Finance and would help the banking sector, a senior ministry official said yesterday.

The banking sector in the world's fourth-largest oil exporter is exposed to the debt of Dubai World.

"The Dubai World offer is better than what we expected," Younus Al Khouri, Director-General at the Ministry of Finance, said yesterday.

"It will have a positive impact on banks."

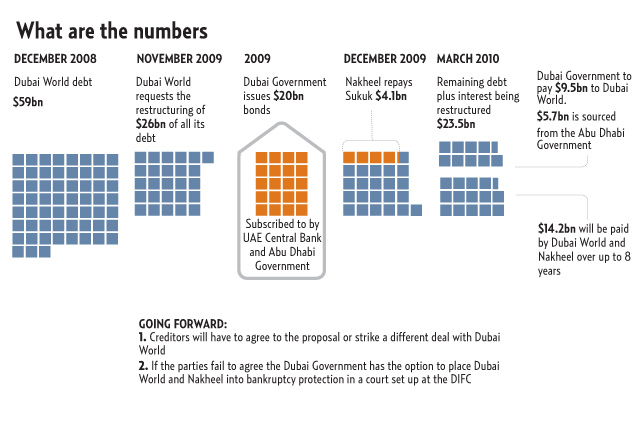

Dubai said on Thursday it would spend $9.5 billion (Dh34.88 billion) to restructure its flagship firm in a plan that offered to repay two key bonds and give lenders their money back in up to eight years.

Dubai stocks rose to an 11-week high on the proposal.

The cost of insuring Dubai debt fell sharply on the day of the proposal, although it began to rise again the following day on doubts about how the emirate would fund its share of the plan, which still needs to be cleared by creditors.

Emirates NBD and Abu Dhabi Commercial Bank are part of a seven-member committee believed to have most exposure to the conglomerate.

Al Khouri said earlier this month the UAE banks were strong enough to absorb any shock, even from Dubai World's restructuring, and no capital injection was needed for now.

Estimates of potential exposure of banks to Dubai World has ranged up to $15 billion.

The UAE Government has, since the onset of the global financial crisis, introduced several measures to shore up local banks' balance sheets.

The UAE still has Dh20 billion left from a Dh70 billion facility set up in 2008 to inject liquidity into the banking system, the ministry has said.

Stocks

Meanwhile, Gulfmena Alternative Investments said yesterday Dubai stocks may climb 15 per cent in the next two months as government support for Dubai World boosts earnings in the world's cheapest major equity market.

Dubai's proposal spurred a 4.3 per cent jump in Dubai's Financial Market General Index and sent the cost of protecting the emirate's debt against default to the lowest since November.

The restructuring plan will reduce losses at local banks that lent to Dubai World and increase payments to real-estate and construction companies such as Emaar Properties and Drake & Scull International, said Hesham Arabi, Chief Executive Officer of Gulfmena.

Overseas investors will boost holdings in the next six months after they left the market in 2008, according to Pictet Asset Management.

"The general trend is upwards, extending all the way into April and May," Dubai-based Arabi said in an interview.

"There's momentum building up. On a market level I would not be surprised to see a 10 to 15 per cent rise."

Even after a 16 per cent rally this month in anticipation of government support for Dubai World, the DFM index trades at 6.5 times analysts' 2010 earnings projections, according to data compiled by Bloomberg. That is the lowest level among benchmark equity gauges in the world's 50 biggest markets and compares with an average of 9.8 since Bloomberg began tracking the data in February 2007.

Positive

The announcement is "more positive than what people dared hope for", said Oliver Bell, a senior investment manager in London at Pictet Asset Management, which oversees about $113 billion worldwide.

Bell said he purchased UAE shares on March 25 for his Middle East and North Africa fund, which outperformed 97 per cent of peers this year.

"Funds will now spend time reassessing them on a fundamental basis as opposed to a speculative basis," he said. "The market will be rocky, but I think from here it goes higher."