Two years ago, I suggested that the US economy is riddled with strangely high costs in key sectors of the economy. Now, more and more people seem to be zeroing in on this problem. Blogger Scott Alexander has a long, excellent rundown of high costs in five areas — K-12 education, college, health care, infrastructure and housing.

He’s right. Americans pay much more for a university education than do people in Europe or East Asia. They pay about twice as much for health care, even though the quality is about the same. And the US pays about twice as much for infrastructure, again without any clear difference in quality.

I’d add one more sector: finance. Retirement saving in the US is dominated by managers who charge fees that seem small, but end up taking a huge chunk of people’s lifetime savings. Real estate agents typically get commissions equal to about 5.5 per cent of the sale price of a home, compared to smaller commissions in most other rich countries.

The glaring difference between the US and its peers in all of these areas casts doubt on the two usual suspects — government intervention and Baumol’s cost disease.

Baumol’s cost disease is a name for the tendency of costs to rise in slow-growth sectors as fast-growth sectors become more productive. As we learn better ways to make things like iPhones and TVs, the economy becomes wealthier. So we’re willing to pay more for services like back massages, string orchestras and university lectures.

But because those services require the same amounts of labour as they did before, their costs rise as rich people pay the same workers more and more for the same old service.

That could be one force behind rising costs; it definitely seems important for K-12 education. But it doesn’t explain why the US is so much worse than countries such as France, Germany or Japan. Those countries are about as productive as the US, so their cost disease should be comparable.

Something else must be afoot.

Another usual suspect is government intervention. The government subsidises college through cheap loans, purchases infrastructure, restricts housing supply, and intervenes heavily in the health care market. It’s probably part of the problem in these areas, especially in urban housing markets.

But again, government intervention struggles to explain the difference between the US and other rich nations. In most countries, health care is mainly paid for by the government — many countries have nationalised the industry outright.

Yet their health outcomes are broadly similar to those in the US, or even a little bit better. Other countries have strong unions and high land acquisition costs — often stronger and higher than the US — but their infrastructure is much cheaper.

And there is no law or regulation propping up high wealth-management fees or real-estate commissions. In general, lower-cost places like Japan and Europe have more regulation and more interventionism than the US.

So if cost disease and government can at most be only part of the story, what’s going on? One possibility Alexander raises is that “markets might just not work”.

In other words, there might be large market failures going on.

The health care market naturally has a lot of adverse selection — people with poor health are more inclined to buy insurance. That means insurance companies, knowing its customers tend to be those with poorer health, charge higher prices.

Also, hospitals could be local monopolies. And college education could be costly in part because of asymmetric information — if Americans tend to vary more than people in other countries with respect to work ethnic and natural ability, they might have to spend more on college to prove themselves.

This is known as singling.

When high costs are due to market failures, interventionist government can be the solution instead of the problem — provided the intervention is done right. So the more active governments of countries like Europe and Japan might be successfully holding down costs that would otherwise balloon to inefficient levels.

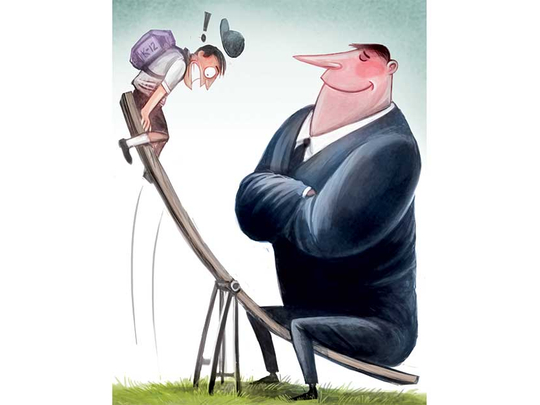

But there’s one more possibility — one that gets taught in few economics classes. There is almost certainly some level of pure trickery in the economy — people paying more than they should, because they don’t have the time or knowledge to look for better prices, or because they trust people they shouldn’t trust.

This is the thesis of the book “Phishing for Phools” by Nobel-winning economists George Akerlof and Robert Shiller. The authors advance the disturbing thesis that sellers will continually look for ways to dupe customers into paying more than they should, and that these efforts will always be partially successful.

In Akerlof and Shiller’s reckoning, markets don’t just sometimes fail — they are inherently subject to both deceit and mistakes.

That could explain a number of unsettling empirical results in the economics literature. For example, transparency reduces prices substantially in health care equipment markets.

More complex and opaque mortgage-backed securities failed at higher rates in the financial crisis. In these and other cases, buyers paid too much because they didn’t know what they were buying.

Whether that’s due to trickery, or to the difficulty of gathering accurate information, it’s not good — in an efficient economy, everyone will know what they’re buying.

So it’s possible that many of those anomalously high US costs are due to the natural informational problems of markets. If that’s the case, the government should mandate better information — more transparent bidding for construction projects, more price disclosure in health care and so on.

The American people, complacent because of long years of prosperity, may need help in learning how to be savvy bargain hunters.