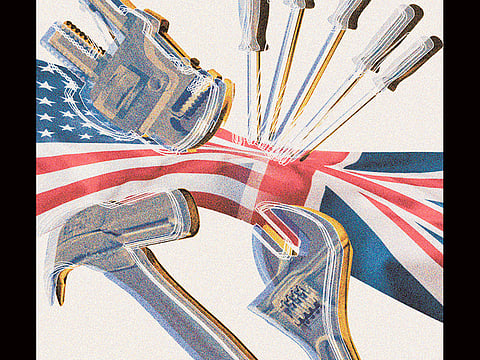

Better get started on the infrastructure repairs

The US and UK are chronically spending less than required to top up networks

The big guns are coming out in the battle over infrastructure spending. Larry Summers, a celebrated Harvard economist and veteran policy adviser, has a new article making the case for spending more. Ed Glaeser, a brilliant and versatile colleague of Summers’ who studies urban economics, has an article making the opposite case.

Though both make many good points, I think Summers has the upper hand.

First, there’s one type of infrastructure spending that everyone should agree we need: repair and maintenance. Although Glaeser talks at length about high-speed rail and other new infrastructure, which may not pay off, even he recognises that maintaining existing transportation networks is likely to yield high returns.

A well-known 1988 Congressional Budget Office survey found that spending to maintain current highways in good shape produces returns of 30-40 per cent.

This return is unlikely to be lower now than in 1988. The US’ system of roads, railways and bridges is largely the same now as then. But the economy supported by that system is much larger, in per capita terms.

Since the economic value provided by our existing infrastructure is a lot bigger than before, the payoff of keeping those roads and railways in good working order has gone up as well. In fact, since there has been an explosion in truck transportation since the late 1980s, roads probably create a lot more economic value per mile than they did back when the CBO did its calculations.

Of course, costs have gone up too. As I’ve written before, it’s very hard to calculate both the costs and the benefits of infrastructure investment. But remember, the alternative to repairing our roads, bridges and rails is to let them decay until they can’t be used.

The payoff from infrastructure repair is avoiding the loss the US economy would take if it suddenly became much harder to transport goods because of potholed roads, fallen bridges and rusted railways. Since that loss would be big, the return to repairing existing infrastructure tends to be very high.

The second reason I think Summers gets the better of the debate is that his argument is more tailored to the US’ present situation. Much of Glaeser’s argument against infrastructure is timeless in nature. He discusses the inefficiency of government procurement and spending choices, and the need for some infrastructure to be built and maintained at the local instead of the federal level.

Although these are certainly true, they’re no more true now than in the past. Meanwhile, Glaeser’s main cautionary tale about infrastructure spending is Japan in the 1990s: “Japan has invested enormously in infrastructure... The New York Times reported that, between 1991 and late 2008, the country spent $6.3 trillion (Dh23.12 trillion) on “construction-related public investment”...

“But while these trillions in spending may have kept some people working, no one can look at the Japanese numbers and conclude that the money has ramped up the growth rate. Moreover, the largesse is part of the reason that the nation now labours under a crushing public debt.”

Glaeser is absolutely right about 1990s Japan. But he’s wrong to use it as an analogy for the US in the 2010s. As Glaeser himself points out, the rate of return on infrastructure varies a lot depending on the country, the time period and the type of infrastructure. One country can spend too much while another spends too little.

And when we compare 1990s Japan to the US today, we see two very different situations. Summers cites a recent McKinsey Global Institute report that clearly highlights the difference.

Japan now spends about 4 per cent of its gross domestic product on infrastructure. This is in contrast to the 2.4 per cent of GDP spent by the US, which is much more spread-out — Japan is smaller than California — and hence probably needs to spend proportionally more on transportation.

McKinsey also calculates how much each country will have to spend on infrastructure in order to meet its economic needs during the next 15 years in order to avoid a substantial growth slowdown. It estimates that Japan is overspending by 1.5 per cent of GDP, while the US is underspending by 0.7 per cent.

So according to McKinsey, countries such as Japan and Australia are overdoing it, while the US and the UK aren’t spending enough. Glaeser’s analogy isn’t a good one.

Of course, spending more isn’t the only thing the US needs to do to improve its infrastructure. Costs are way too high, and these need to be brought down — an undertaking that will probably take decades. The McKinsey report also acknowledges this problem, and recommends improvements to the financing, contracting and approval processes.

But just because the US has a cost problem when building infrastructure doesn’t mean it should spend less. It should spend more, while simultaneously looking for ways to improve efficiency and quality.

The first priority is to repair what exists. Yes, it’s possible to spend too much on infrastructure, but the US faces the opposite problem.

The writer is an assistant professor of finance at Stony Brook University.

Washington Post