Whether you want to buy art to diversify your investment portfolio or to simply decorate your home, you will hardly find any asset class that combines business and pleasure as effectively as collectible art.

In fact, with the growing popularity of art as assets, investors in the Middle East are increasingly turning to this class for handsome returns on investment.

When it comes to investing in art, the simplest way to proceed is to cultivate a passion for it, suggests Andrew Prince, Senior Consultant at Acuma, a provider of financial planning solutions in the GCC. “Visit galleries, read a lot of auction catalogues, buy a broad spread of work and then wait for it to appreciate in value over time,” he says.

Investing in the right art pieces can generate huge returns.

“The buyer of Peter Doig’s painting The Architect’s Home in the Ravine paid £314,650 [Dh1.85 million] at an auction in 2002. Recently, the painting was sold at Christie’s for £7.7 million,” says Prince.

“Ignoring fees and taxes, the buyer must have gotten returns in excess of 2,400 per cent in 11 years.”

However, he adds, art by nature is an illiquid investment and a quick sale at the valued amount cannot be guaranteed. “In some respects, it is similar to private equity funds and direct property holdings,” he says.

Like the stock market, the art market is also fickle — it involves a lot of risk and it is also specialised.

“Unless you choose an art fund as part of a managed portfolio, it’s risky to put all your eggs in one basket by buying just one painting,” warns Keren Bobker, Senior Consultant at Holborn Assets.

To achieve a good return, purchase art with a documented history. Renaissance and old master art are always in demand and they also escalate in value. Currently, Chinese art, classic cars and jewellery are also performing well, points out Deborah Najar, Regional Representative of Bonhams.

Safe investments

Buying a Picasso or a Warhol is often considered a safe investment.

“In my opinion, a safe investment can also be sponsoring a young artist with production money and buying his works until he can make his way into the art world and gain value,” says Victoria Gandit Lelandais, Collectors’ Circle Coordinator at Art Dubai, one of the top contemporary art fairs in the GCC.

“Be patient, train your eyes, know what you like and dislike and ultimately buy something that you like,” advises Lelandais.

You can also visit art fairs to gain a broader view of the market.

“When investing in art, it is also wise to have someone to help you make the most strategic decisions,” Najar adds.

The global art market has witnessed consistent growth in the past decade, with international art sales reaching more than $64 billion (Dh235 billion) last year. Although many people buy art for money, experts advise not to treat them as stocks and bonds.

Instead, treat it as a unique investment that gives the collector the opportunity to enjoy its beauty for years before selling it for a profit. Besides, art is always a long-term investment, so give your investment time and allow it to appreciate.

Demand for collectible artwork has picked up in the UAE, thanks to serious buyers and investors, including a growing segment of young buyers who are willing to invest in affordable art.

“Over the past seven years we have seen a very encouraging growth in our Middle Eastern client base and this is also reflected in the general development of Dubai’s art scene,” says Michael Jeha, Middle East Managing Director, Christie’s.

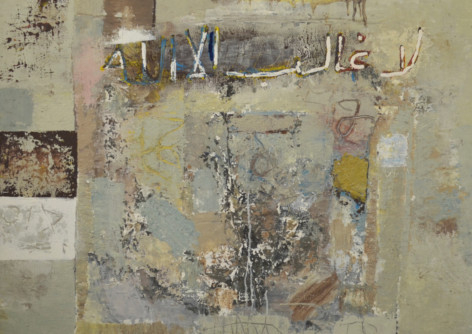

Middle Eastern art

The market for contemporary works by Middle Eastern artists is also growing steadily.

“Today, 40 per cent of our Middle Eastern art collection is sold to international collectors, while the rest is purchased by regional buyers,” says Jeha. “We are increasing our sales volume year-on-year.

“This year, we have the first online-only sale of Middle Eastern art because demand has grown enormously.”

During Christie’s Middle East’s two-day sale at the Emirates Towers last week, Fahr El Nissa Zeid’s Break of the Atom and Vegetal Life was sold for $2.7 million, the second-highest price for a work by a Middle Eastern artist.

The most expensive piece from the region is Oh Persepolis by Parviz Tanavoli, which sold for $2.8 million in 2008.

Bonhams has also noted a rise in demand for artists from the region. The auction house sold Farhad Moshiri’s Love for a record price of $1.08 million in 2008 in Dubai.

With changing platforms for display and advancement in technology, installation art, collectible photographs, antiques and sculptures are fast replacing paintings as the new focus of the new generation of collectors.

“The natural evolution of art is definitely towards the use of newer technologies, such as photography, video art and sound and light installations,” says Lelandais.

Photography

Experts are extremely upbeat about the growth prospects of fine art photography, suggesting that photography could be the next big category to look out for as it is still undervalued.

“Photography is a very good medium for a starting point of a collection and it is appreciated by younger collectors, as prices are more affordable,” says Jeha.

“You can still find works by the masters of photography such as Richard Avedon, Irving Penn, Ansel Adams, Peter Lindbergh and Horst P. Horst at reasonable prices. Furthermore, photography offers a wide range of subjects and fields to explore.”

A note of caution from experts: investing in art can be complicated. If you wish to include art in your portfolio, choose an expert to pick works for you.

“For those who don’t necessarily have an eye for good art or the money, storage facilities and knowledge required to maintain such an investment, accessing this esoteric asset class through an investment vehicle could be the preferred option,” says Prince.