Dubai: Saudi Arabia and its allies are warning that US legislation allowing the kingdom to be sued for the 9/11 attacks will have negative repercussions.

Riyadh maintains an arsenal of tools to retaliate with, including curtailing official contacts, pulling billions of dollars from the US economy, and persuading its allies in the Gulf Cooperation Council — the UAE, Kuwait, Bahrain, Qatar and Oman — to scale back counterterrorism cooperation, investments and US access to important regional air bases.

“This should be clear to America and to the rest of the world: When one GCC state is targeted unfairly, the others stand around it,” said Abdul Khaleq Abdullah, an Emirati Gulf specialist and professor of political science at the UAE University.

“All the states will stand by Saudi Arabia in every way possible,” he said.

When Saudi Arabia wanted to pressure Qatar to limit its support for the Muslim Brotherhood group in Egypt, it spearheaded an unprecedented withdrawal of Gulf Arab ambassadors from Doha in 2014 and essentially isolated it within the GCC.

When Sweden’s Foreign Minister Margot Wallstrom strongly criticised Saudi Arabia’s human rights record last year, the kingdom unleashed a fierce diplomatic salvo that jolted Stockholm’s standing in the Arab world and threatened Swedish business interests in the Gulf. Sweden eventually backpedalled.

Chas Freeman, former US assistant secretary of defence and ambassador to Saudi Arabia during operation Desert Storm, said the Saudis could respond to this bill in ways that risk US strategic interests, like permissive rules for overflight between Europe and Asia and the Qatari air base from which US military operations in Afghanistan, Iraq, and Syria are directed and supported.

“The souring of relations and curtailing of official contacts that this legislation would inevitably produce could also jeopardise Saudi cooperation against anti-American terrorism,” he said.

Fahad Nazer, an analyst at intelligence consultancy JTG and a former political analyst at the Saudi Embassy in Washington, said he’d be surprised if Saudi Arabia cut back counterterrorism cooperation since it’s been beneficial for both countries.

Still, relations with Washington had already cooled well before the 9/11 bill sailed through both chambers of Congress.

The Saudis perceived the Obama Administration’s securing of a nuclear deal with Iran as a pivot toward its regional nemesis. There was also President Barack Obama’s criticism of Gulf countries in an interview earlier this year, despite their support for the US-led fight against Daesh in Iraq and Syria.

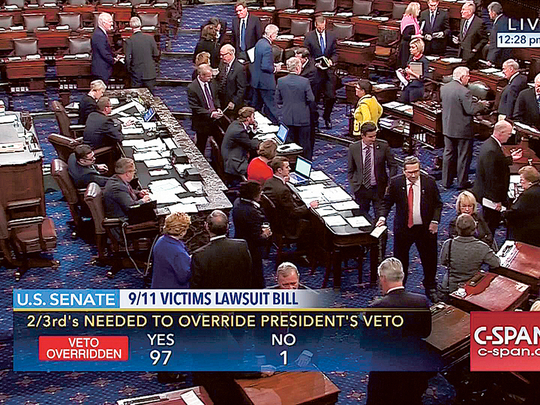

Obama vetoed the Justice Against Sponsors of Terrorism Act, or Jasta, arguing that allowing US courts to waive foreign sovereign immunity could lead other foreign governments to act “reciprocally” by giving their courts the right to exercise jurisdiction over the US and its employees for overseas actions. These could include deadly US drone strikes and abuses committed by US-trained police units or US-backed militias.

His veto was subsequently overridden by Congress on Wednesday.

Saudi Foreign Minister Adel Al Jubeir told reporters in June that the US has the most to lose if Jasta is enacted. Despite reports that Riyadh threatened to pull billions of dollars from the US economy if the bill becomes law, Al Jubeir says Saudi Arabia has only warned that investor confidence in the US could decline.

Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics, said estimates put the figure of official Saudi assets in the government at somewhere between $500 billion (Dh1.83 trillion) and $1 trillion when considering potential foreign bank deposits and offshore accounts.

The kingdom had $96.5 billion in holdings of Treasury securities in August, according to the most recent number released by the Treasury Department. Saudi Arabia ranked 15th in its holdings of US Treasury debt.

Gagnon, who previously worked at the US Federal Reserve Board and Treasury, said there isn’t much realistically that the kingdom could do to move against the dollar or other US assets “that would hurt us a tenth as much as it would hurt them”. He said the US would actually welcome downward pressure on the dollar and questioned what other markets are big enough to absorb what they could sell.

The US-Saudi Business Council’s CEO and Chairman Ed Burton says business between the two countries will continue, though potential deals could be jeopardised by Jasta.

“No business community likes to see their sovereign nation basically assailed by another nation,” Burton said.

As one of the world’s largest oil exporters with the biggest economy in the Gulf, Saudi Arabia also has other business partners to choose from in Europe and Asia, said David Hamod, President and CEO of the National US-Arab Chamber of Commerce.

The CEOs of DOW and GE sent letters to Congress warning of the bill’s potentially destabilising impact on American interests abroad.

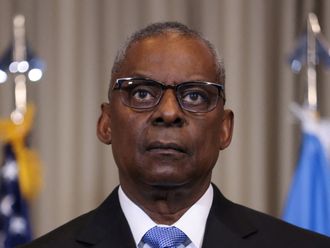

Defence Secretary Ash Carter this week sent a letter to Congress saying “important counterterrorism efforts abroad” could be harmed and US foreign bases and facilities could be vulnerable to monetary damage awards in reciprocal cases.

Such reactions may not come directly from Riyadh but countries connected to Saudi Arabia, said Stephen Kinzer, a senior fellow at the Watson Institute for International and Public Affairs at Brown University.

He said the eight-decade-long US-Saudi relationship is “entering into a new phase”, in which ties will be mostly underpinned by arms sales, unlike during the era of warm relations under president George W. Bush.

Abdullah, the Gulf analyst at UAE University, said he expects to see a GCC that acts more assertively and independently of the US in places like Yemen, Bahrain and Egypt.

“This is not just a threat. This is a reality,” he said.