Dubai: A constant refrain by local SMEs is that they are starved of third-party funding support during the formative years of the business. And whatever funds are available tend to be from government or semi-government sources.

This begs the question: What is the private sector doing to support SME initiatives?

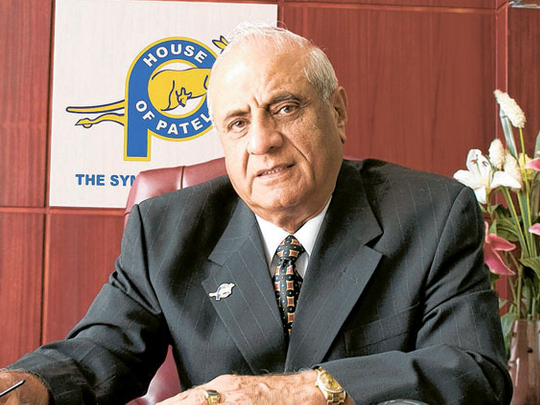

A lot, if Asgar Shakoor Patel, chairman of House of Patels, has anything to do with it. He is putting together a funding programme that will look at start-ups or businesses in their early years and he is putting in his own money to make it happen.

So will the funding take the form of microfinance or be a more complex private equity play?

"You can call it by any name, but the concept is to support SMEs with equity capital in their earlier years," Patel said.

"If they take on debt, it will involve servicing cost, hence our idea of providing equity. Once they turn profitable and are capable of standing on their own legs, we will exit as they can either plough in funds generated by them or banks will be willing to help. Yes, we want to restrict our participation to a certain scale, but still good enough to see the enterprise through the infant years," he said.

The funding initiative will be a solo effort by the House of Patels, at least initially. Going forward, if the model turns out to be profitable and more funds are required, partnerships would be considered. The structuring of the funding programme is being decided, but ideally would have a five- to ten-year horizon.

To raise funds should not be an issue for the House of Patels, a diversified group that has interests in logistics, financial services and construction and operations straddling multiple markets.

A $1 billion (Dh3.6 billion) enterprise marking its 50th year of operations, it employs more than 10,000 people and has group entities publicly listed on the Indian stock market.

What should a candidate SME be to get the fund's promoter interested?

"Basically we are looking at companies that need bridge finance until they are capable of accessing bank funds or internally generate sufficient funds," said Patel.

"We may also be able to add value to companies who are in finance, forex, construction and logistics among other sectors — by bringing in expertise from our Indian companies who have experience in these fields."

The intention is to take equity as that works to keep the costs down for the small business compared to taking out a debt and then having to service it.

And the funding parameters can be stretched where necessary to "look at companies that have been in operation for a few years and seek financial support," Patel added.

In the current market situation, access to credit and credit terms are rated as "dispiriting" to "enough to get through the immediate needs", depending on feedback from local business owners.

Local banks are certainly more active in the space, but the turnaround time for a business owner to actually get his hands on the funds is an area that could do with some improvement.

Patel expresses no surprise at the situation.

"As credit conditions remain relatively difficult, SMEs are expected to face credit challenges," he said.

"However, these problems are not simply on account of the recent credit crunch. SMEs in particular are known to face difficulties in getting finance," he said.

"The factors that motivate banks to engage in SME lending include the potential profitability of the SME market, the saturation of the large corporate market, the need to enhance returns and the desire to diversify risks. But the share of lending to SMEs in the total lending in the GCC are substantially below the banks' own long-run targets. The average share of SME lending is consistently low across all GCC countries," he added.

"It reflects to a large extent the structure of oil-based economies — less diversified, dominated by very large enterprises, and characterised by appreciated exchange rates and small non-oil traded sectors. There is substantial scope and huge potential for financing of SMEs."

Access to credit

Financial limitations

Surveys by the World Bank and Union of Arab Banks show that only a marginal percentage of SMEs have access to loans or a line of credit compared to large firms. In fact, 20 per cent of SMEs in the Mena territory have loans or a line of credit, a significantly lower share than in all other regions except Africa.

"There are many entrepreneurs from Asia and the GCC who have started companies in the UAE," said Asgar Shakoor Patel.

"They have set up restaurants, educational institutions, pharmacies, supermarkets, medical clinics among other such businesses. After a couple of years they find it difficult to continue due to financial constraints and lack of credit lines from banks."

Patel

Business savvy

Asgar Shakoor Patel has form when it comes to launching a business and then selling equity to a strategic investor.

The House of Patels owned the Wall Street Exchange which eventually grew into a nine branch network in the UAE. Emirates Post thereafter acquired a 60 per cent stake in the financial services firm.

"It is not possible to hold all the good cards in life — what is important is how well you play with the cards you hold," Patel said.