Dubai: The UAE’s banking sector that came under pressure from huge spike in loan loss provisions and squeeze on profitability from COVID-related economic contraction last year are seen fast recovering.

Thanks to the improving economic outlook, the loan demand is picking up and the pace of loan impairments are abating.

The first quarter results of most of the leading banks in the UAE points to improving operating conditions characterised by better non-interest incomes, gains in cost savings and significant reduction in loan loss provisions supporting profitability.

Although the first quarter numbers indicate a small improvement in loan growth, interest incomes continued to be under stress due to the low interest rate environment, somewhat offset by savings from lower cost of funds.

Lower loan losses

Most banks in the country have reported lower loan impairments in the first quarter of 2021. While lower loan loss provisions have boosted profitability of banks, there could be more risks of impairments masked by loan deferrals and restructurings supported by the Central Bank of UAE’s regulatory forbearance measures.

Additionally, the banks’ policy of prudent advance provisioning has significantly ironed out the possibility of a sharp spike in bad loans.

“The COVID-19 pandemic, lower oil prices, and continued pressure on the real estate sector have increased risks for UAE banks, and we expect banking sector's problem loans to increase further once the regulatory forbearance measures are lifted and banks start to account for the impact of the economic shock. However, we expect this process to be gradual, minimising the impact on the banking system,” said Puneet Tuli, an analyst at Standard & Poor’s.

Central bank support

The CBUAE’s timely support to the banking sector through its Targeted Economic Support Scheme (TESS) reduced regulatory pressure on banks making provisions while helping corporate, small and medium enterprise and retail borrowers.

Although the scheme did not reduce credit risk on the banking system's balance sheet, it included a provision that allows banks not to classify deferred exposures as Stage 2 and Stage 3 under the IFRS 9. Instead banks have classified deferrals into two groups: Group 1 (exposures to clients that are temporarily and mildly impacted); and Group 2 (exposures to clients that are significantly impacted and could see potential stage migrations) and disclosed the information. At year-end 2020, 12 per cent of the top 10 banks' exposures were classified as Group 1 and 2 per cent as Group 2.

Bankers said the central bank move has significantly reduced immediate provisioning pressures on banks, although many banks continue to make prudent provisioning to avoid a major spike when the CBUAE discontinue the support scheme.

“It is not prudent to say that all asset quality issues are behind us. But, a combination of advanced provisioning by banks and the central bank support in loan classifications have given banks enough time to absorb the loan losses in an orderly manner,” said the chief financial officer of a leading UAE bank.

Bankers and analysts agree that UAE banks will continue to face asset quality challenges for the next 2 years, but will be able to navigate the ongoing macroeconomic challenges, owing to their strong capital buffers and good profitability.

Challenges from key sectors

According to S&P analysts, the UAE economy is going through a correction phase. The pandemic has provided a renewed challenge to the economy and real estate market.

The coinciding to an economic slowdown when the real estate sector is under significant stress and other UAE sectors, such as hospitality, trade, and discretionary consumer goods, are experiencing a marked decline in revenue is posing challenges to overall asset quality and profitability.

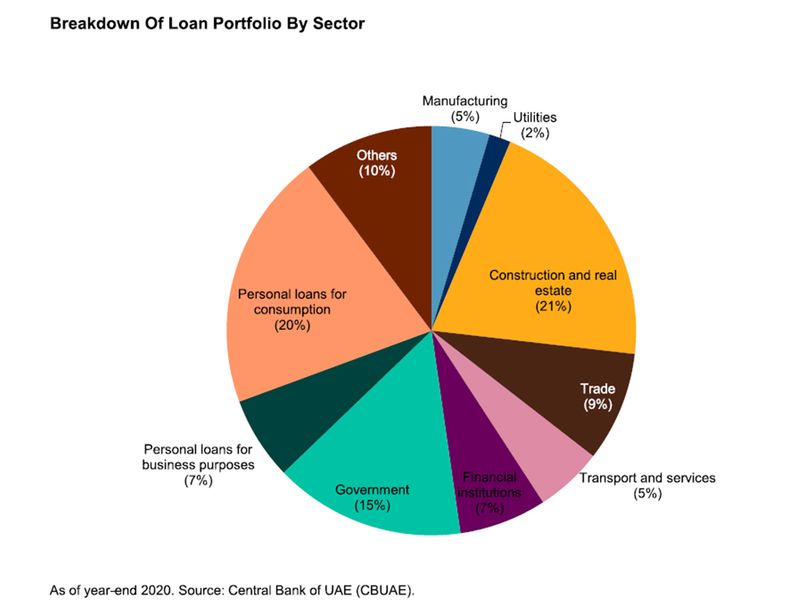

The banking system's total exposure to the real estate and construction sectors stood at 28 per cent as of year-end 2020, assuming that one-third of personal loans for consumption purposes are channeled to real estate. Residential real estate prices have declined more than 40 per cent since the peak in second-quarter 2014 meaning a significant equity erosion.

Bright loan growth outlook

Loan growth was nearly flat in 2020 with a mere 1 per cent loan book growth, compared with 6 per cent in 2019. While the pandemic related business risks and job losses forced both corporates and individuals to postpone borrowing, banks also tightened their lending standards to reduce potential loan losses.

Early indicators in the first quarter of 2021, point to improving loan demand supported by some easing in credit standards.

The latest credit sentiment survey (a survey of credit officer in banks) of the CBUAE showed that banks expect both corporates and retail lending to pick up pace on improved loan demand and banks’ willingness to soften credit standards.

Survey results revealed a marginal easing in maximum Loan-to-Value (LTV) and maximum Loan-to-Income (LTI) ratios, while fees and charges tightened marginally. In terms of outlook for the June quarter, survey respondents are expecting terms and conditions pertaining to maximum LTV and LTI to continue easing, while fees and charges are expected to continue tightening, although to a lesser extent than the March quarter.

Rating agency Moody’s said although the pressure on net interest income, banks’ main revenue source, will persist through 2021, reflecting prolonged low interest rates, the impact of this will be softened by higher lending volumes as coronavirus-related restrictions ease and the vaccination rollout helps lower infection rates.