Dubai: Lebanon’s decision to defer payment is likely to result in significant losses for private creditors, credit rating agency Moody’s said on Tuesday.

According to Moody’s analysts the sovereign debt default would have serious implications for Lebanon’s banking sector and the decision to defer payment of bond maturity reflects the country’s extreme financial and economic pressures and the move will likely lead to big losses to banks.

A sovereign default would have a significant negative impact on banks’ financial health, and further undermine the economy and the sustainability of the peg.

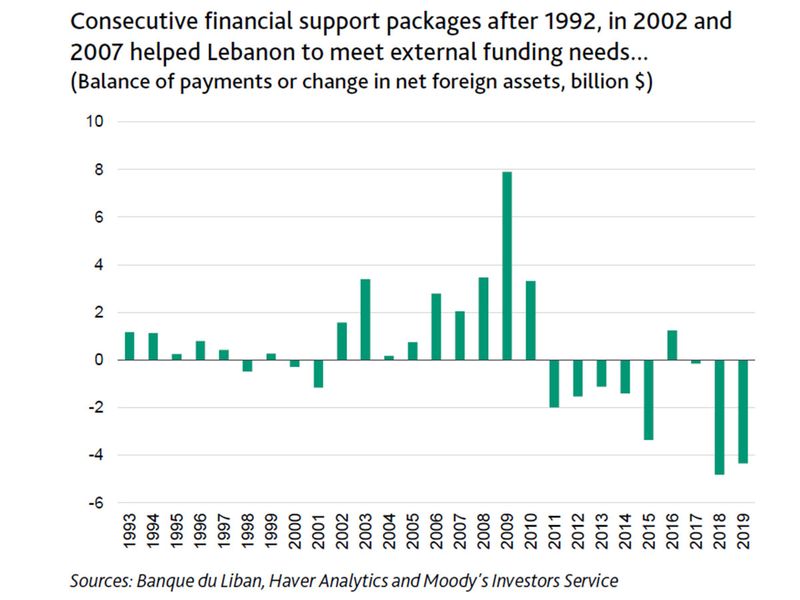

The rating agency sees Lebanon's deteriorating balance of payments, with the closure of trade routes to Syria and large refugee inflows, has gradually undermined the sustainability of the country’s funding model based on foreign direct investment and capital inflows mainly from the GCC and the Lebanese diaspora.

Ruptured funding model

The rating agency sees depreciation of the Lebanese pound would significantly inflate the government’s debt burden, with benefits in increased competitiveness only materializing over the longer term., with the closure of trade routes to Syria and large refugee inflows, has gradually undermined the sustainability of the country’s funding model based on foreign direct investment and capital inflows mainly from the GCC and the Lebanese diaspora.

“A sovereign default would have a significant negative impact on banks’ financial health, and further undermine the economy and the sustainability of the peg,” said Elisa Parisi-Capone, a Moody’s Vice President - Senior Analyst.

Pressure on banks

Moody’s said the Bank du Liban’s (BdL) [Lebanon’s central bank] measures over the past few years to incentivize fresh deposit inflows from abroad and therefore support the government’s borrowing requirements and foreign exchange reserves have increased close balance sheet interlinkages between the sovereign and the financial system.

“A government default will have a significant negative impact on banks’ financial health, which will in turn further undermine the economy and the government’s balance sheet. We expect the unraveling of this leveraged funding model to result in comparatively high losses for private creditors in light of the public sector’s weak loss absorption capacity,” said Parisi-Capone.

Geopolitical headwinds and domestic political deadlock have further hindered crucial deposit inflows, while the central bank’s measures to support financing of government debt and the economy could not compensate for delays in international financial support in the absence of credible fiscal reform.

Peg under threat

Moody’s expect the very low level of foreign exchange reserves exert downward pressure on the Lebanese pound.

“We assess pressure on the Lebanese pound’s currency peg to be acute, pointing to a possible abrupt and very large change in the exchange rate. According to standard measures for foreign-exchange reserve adequacy for sovereigns with a fixed exchange rate and a large banking system, the BdL’s foreign-exchange reserves have declined to or fallen below minimum levels,” said Parisi-Capone.

In the event of a collapse of the peg, Moody’s expect the depreciation of the Lebanese pound would significantly inflate the government’s debt burden, with benefits in increased competitiveness only materializing over the longer term.