LONDON

Starling Bank, a British financial start-up that lends via smartphones, is targeting expansion in the European Union even as the future of cross-border banking comes under threat from Brexit.

The company run by former Allied Irish Banks Plc executive Anne Boden won approval from the Bank of England to operate in Ireland under the EU’s passporting arrangements, according to a statement on Monday. The expansion, which must be granted by a bank’s home regulator, comes less than a year after the company gained its UK banking license.

“The Irish market is one I know well and it’s also a great place to start a European international expansion plan,” Boden said in an interview. “We are very aware of the implications of whatever happens from Brexit, and we have plans in place for whatever alternatives we need to make.”

Starling Bank is among a growing number of new UK-based lenders to win licenses from the central bank to compete in Britain’s oligopolistic consumer-banking industry, where four lenders control as much as 80 per cent of the market. Others such as Monzo Bank Ltd. are looking to open in Europe in the near future while Spain’s Banco Bilbao Vizcaya Argentaria SA owns a stake in Atom Bank alongside fund manager Neil Woodford. Many of them use technology to reach clients.

Global banks from HSBC Holdings Plc to JPMorgan Chase & Co. have warned that Britain’s departure from the EU could force them to relocate jobs from London to countries within the trading bloc if the UK lose its ability to offer passporting rights to sell financial-services products. Starling will open to Irish customers and can make any changes required for Brexit within the next 18 months, Boden said.

“We took the view that we wouldn’t let lack of certainty around this stop customers from being able to use Starling,” she added. “We’ve now launched in the UK and things are going well; we’re quite keen to start our expansion into Europe over the next couple of years.”

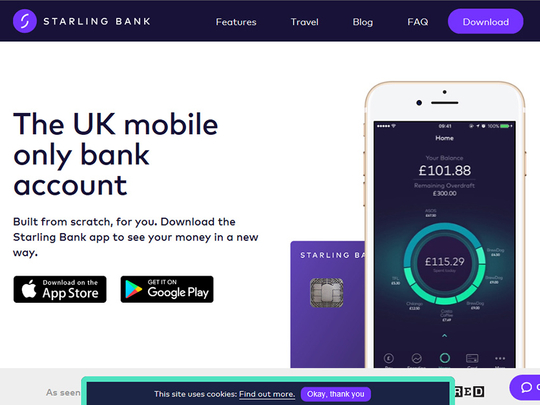

Starling offers checking accounts via mobile phones and enables rival lenders and financial technology companies to market services to its clients. The firm won’t say how many customers it has until the third quarter or disclose its revenue yet, Boden said.