Dubai: Profitability metrics of UAE based Islamic banks are expected to improve this year with lower financing impairment charges, however, profits are unlikely to return to previous levels due to persistently higher, albeit improved, funding costs, according to rating agency Fitch.

Fitch expects financing growth to slow to high-single digits in 2017 (still higher than conventional banks) and the recently granted financing portfolios to start seasoning, with a consequent mild deterioration in the Islamic banks’ impaired financing ratios.

UAE Islamic banks’ performance in 2016 was hit by higher funding costs and financing impairment charges with stronger financing growth than conventional banks, according to Fitch.

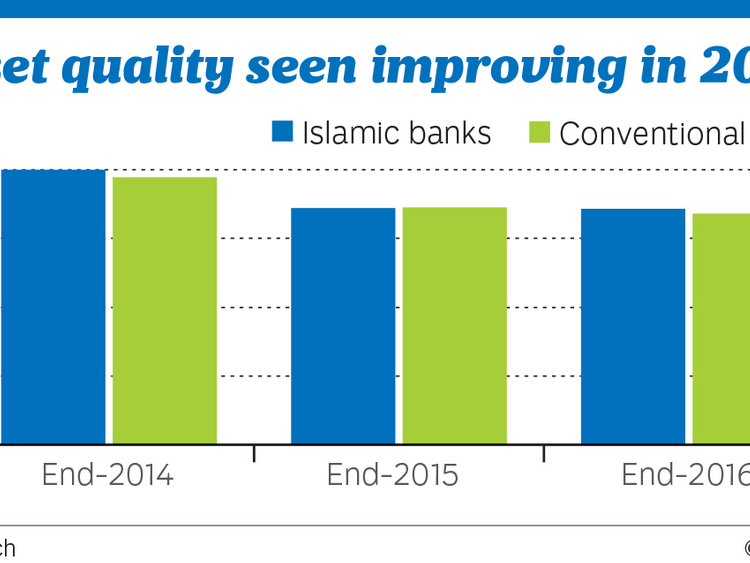

While the average Islamic bank’s impaired financing ratio improved further to 5 per cent in 2016, aided by rapid financing growth (above conventional banks), this ratio is skewed by the two largest UAE Islamic banks, which account for almost two-thirds of Islamic banking assets, and whose ratios have fallen sharply to around 4 per cent. The other four Islamic banks have young, fast-growing franchises, and their impaired financing ratios are between 5 per cent and 9 per cent.

Innovative structuring

Impairments increased to 1.4 per cent of financing in 2016 from 1.1 per cent due to deterioration in the small and medium enterprises (SME) segment. Islamic financing grew at a slower rate of 10 per cent compared to 19 per cent in the previous year due to wider adoption and more innovative structuring of Sharia-compliant products.

“Higher funding costs in 2016 put pressure on most Islamic banks’ net financing margins and operating profitability metrics, despite many banks successfully repricing their financing books. The main reasons for the increase are UAE banks’ high reliance on profit-bearing time deposits and lower liquidity in the system due to lower oil prices,” Bashar Al Natoor, Global Head of Islamic Finance, Fitch said in a note.

The Islamic banks’ average cost/income ratio was almost stable due to tight cost control. Higher financing impairments also affected profitability, consuming 38 per cent of pre-impairment operating profit compared to 33 per cent in 2015.

Capital and liquidity

UAE Islamic banks have been experiencing tightening of liquidity from mid-2015 which continued into 2016. The average financing/deposits ratio rose to nearly 95 per cent, and is now much closer to that of the conventional banks. Islamic banks tend to have higher levels of deposit funding than conventional banks, as their retail focus gives them a larger influx of retail customer deposits, although this has reduced with further sukuk issuance in 2016.

UAE Islamic banks improved their capital ratios in 2016 despite financing growth, mainly through issuing additional Tier 1 capital and improving internal capital generation. Nevertheless, their average Fitch core capital ratio of 13 per cent is below conventional banks’ 15 per cent, due to higher financing growth since 2012, and this ratio is low in light of high concentration risk (by single borrower and by sector). Nevertheless, the capital ratios varied significantly across Islamic banks, from 9 per cent to 20 per cent, at end-2016.

The UAE Central Bank’s centralised Sharia board was further formalised in 2017. In light of the Dana Gas declaring its sukuk non-Sharia compliant, the mandate of a centralised Sharia board and the extent of its involvement in sukuk standardisation are more important than ever. However, there is still limited clarity on the board’s mandate and influence. Fitch-rated UAE banks have no exposure to this sukuk.