RIYADH

Russia is seeking to finalise multi-million-dollar investment deals with Saudi Arabia in the next three months including partnerships with state oil giant Aramco, Russia’s top state investment officer said on Wednesday.

Russian banks and a Russian-Chinese investment fund are also keen to take part in Aramco’s initial public offering (IPO), the head of the Russian Direct Investment Fund, Kirill Dmitriev, told reporters, reiterating comments he made last month.

The move is aimed at strengthening energy ties between the two major oil producers.

Dmitriev told Reuters last month that there was great interest in the Aramco IPO from Russian pension funds and Chinese partners.

Sources told Reuters last year that Chinese state oil companies were willing to be cornerstone investors in the Aramco IPO, which could become the world’s biggest, valuing the firm at up to $2 trillion and raising more than $100 billion.

“There are a number of investors who would like to invest in the Aramco IPO, including several banks,” Dmitriev said on Wednesday.

“Not only this, we have a Russia-China investment fund, and through that Russia-China investment fund we see a major interest in the Aramco IPO from a number of leading Chinese institutions.” Saudi officials have said the government plans to sell up to 5 per cent of Aramco shares on one or more foreign exchanges in addition to Riyadh.

“We will see how the IPO process progresses but we see significant interest to invest in the Aramco IPO, from Russia, from China. We believe this is very good for, once again, thinking jointly about oil,” he said.

Dmitriev also said the Russian Direct Investment Fund, the Saudi Public Investment Fund and Aramco planned to invest in several projects through their joint energy platform including in Russia’s Eurasia Drilling, a major independent driller.

“We expect to finalise an agreement very shortly to have our energy platform with Saudi Aramco invest in Eurasia Drilling and also provide services to Saudi Aramco,” Dmitriev said.

An announcement was expected later on Wednesday on a partnership between Aramco and a liquefied natural gas project in Russia, Dmitriev said.

Russia also has significant investments in Saudi Arabia’s petrochemicals industry, he said.

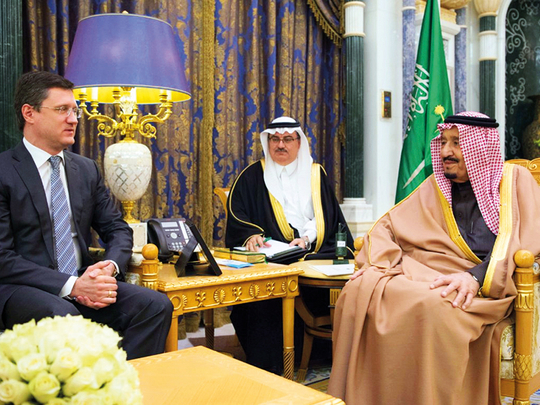

Sibur, Russia’s largest producer of petrochemicals, is building a petrochemicals facility in the kingdom. Russian Energy Minister Alexander Novak had said in October the deal would be worth $1.1 billion.

“Sibur, jointly with us, is building a petrochemical facility focused on ... manufacturing, which is really one of the big Russian projects in Saudi Arabia and underscores the potential for cooperation in petrochemicals,” he added.

In October, Russia and Saudi Arabia announced a $1 billion fund to invest in energy projects.

Dmitriev also said a global deal between the Organisation of the Petroleum Exporting Countries and some non-OPEC producers to cut crude supply was stabilising the oil market.

Russia and Saudi Arabia are leading the supply deal, which runs until the end of 2018.