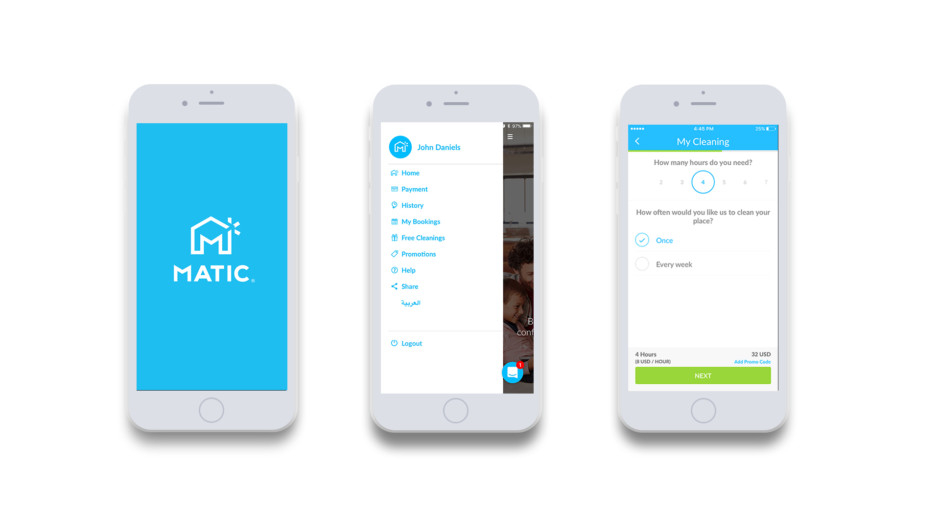

Dubai: Find anything common between the on-demand cleaning services business Matic and Anghami, the music streaming app? Or for that matter between WeGo, the travel-focused search engine, and Altibbi, a subscription-based health care provider?

At first glance, there seems little in common among them, apart from the fact that they are still in the early years of being a business entity. But look closer... and you will find they have a common shareholder-investor — Middle East Venture Partners (MEVP).

And the fact that these businesses are still working their way towards regional exposure is the common factor that MEVP finds so interesting. Half of the investors in MEVP are from Saudi Arabia. So far, it has raised $220 million (Dh808 million).

“It’s not disruptive business models we are after,” said Walid Hanna, founder and CEO of the venture capital firm. “All of the investments we have made have common business models to companies that you see in the West or East. But they need to be digital.

“In this part of the world, we are not betting on that type of disruptive models you see coming out of Silicon Valley. There will be very few of such models in the Middle East... unfortunately. And we cannot take a lot of risk with investing in a business model that has not been proven.

“A lot of disruptive tech coming out of the region has more chances of failure. We cannot take this risk — because we do not get rewarded on the upside since there is not much of an IPO market (for start-ups/early stage businesses).

“Since there is not much that can be done through IPOs, what we make — our exit multiples — are capped from the trade sale (to other investors). So, why take the downside risk too much if our upside risk is limited? This is our investment philosophy.”

Clearly, Hanna is not one to take a sort or emotional approach when it comes to picking up investments. So far, MEVP has had exposures in 43 entities and exited three of them. (With Anghami, which Hanna calls the ‘Spotify of the region’, his firm has made two partial exits. And with a return 21 times the investment.)

But if MEVP goes for regional entities that take on proven business models from elsewhere, can’t the originals come into the Middle East and compete? Or even acquire the local/regional entity? One only needs to look at what Amazon did with souq.com to build up a presence in the Middle East.

“Sure, they can come in and compete in the region... but for most international businesses, they have other market priorities to take care first,” said Hanna.

“The Middle East is before Africa but comes after everybody else. They have to take care of Asia, Latin America before the Middle East. And local/regional entities can get closer to understanding and doing what it takes to meet local consumers’ preferences. You cannot just copy and paste.

“Careem made it in Saudi because it offered cash — in-the-car services for users (instead of just taking payments through credit card transactions). Then Uber — for the first time — ended up offering the same.

“Look, everybody has copied what happens in Silicon Valley. There’s very little innovation outside of Silicon Valley.

“What we do is take the execution risk when committing investments and not on the business model. We don’t do bio-tech or blockchain tech, and never hardware. There is some AI [artificial intelligence] here and there, but the base of our investments is around software.”

Typically, MEVP does not commit to businesses chasing seed funding. Its preference is for entities that have built up some sort of operational traction or are on the cusp of doing so.

“We did a few seed rounds, of $100,000-$200,000, but never written out the big cheques for these,” said Hanna. “Then we get an option to reinvest and that’s how we’ve done it. We’ve written off three to four seed rounds, which is fine, but never $1 million, $2 million or 5 million.”

MEVP scouts for possibilities with those entities that seek Series B funding.

“If we then take up 10-20 per cent in a business, we will definitely ask for a seat on the board,” the CEO said. “We do so because we want to be sure synergies — theirs and ours — can be aligned.”

Will MEVP exert its influence right down to the level of the founder/owner of the business?

“If we realise the owners know the business better than we do, then we don’t,” said Hanna. “But with one of the CEOs at one of the companies we invested, we found ourselves in a conflicting situation. The business was not performing well and at some point was even bankrupt. We decided to replace him... and the company is doing well.”

Going forward, MEVP’s focus will remain singularly on digital possibilities.

Any chance it might consider an exposure in a brick-and-mortar business going online?

“It’s never going to be the other way round — from brick-and-mortar to digital. That rarely works. The DNA has to be pure digital.”

Timing the exit strategy

* Given that its preference is to enter a business through its Series B funding, MEVP’s ideal time frame for an exit is to wait five to six years.

“It’s in the last couple of years that we started focusing on Series B rounds,” said Walid Hanna of MEVP. “If you invest in Series A, you have to wait about eight to nine years. The ideal Series B candidate for us would be somebody operating a mature business model and requires a $5 million ticket to grow to the next level.”

* Investing in Matic, the online on-demand cleaning services business, was a perfect fit with MEVP’s investment strategy. “It [cleaning services] might be a pretty crowded in Dubai, but not in Saudi Arabia,” said Hanna. “They were able to crack the supplier market in Saudi Arabia, and there are four to five licensed suppliers of cleaning personnel there. The business is making $400,000-$500,000 a month now.”