Abu Dhabi: Extension of oil output agreement beyond March will be in focus as top oil executives from across the globe will gather in the capital as part of Abu Dhabi International Petroleum Exhibition and Conference that kicks off on Monday.

The four day event will see the participation of some of the top executives including heads of Abu Dhabi National Oil Company (Adnoc), Total, BP, Pemex, among others as well as energy ministers from Gulf countries and Opec secretary general Mohammad Barkindo.

The event takes places as oil prices rise due to political tensions in Saudi Arabia and tightening of global oil markets following production cut agreement between Opec and non-Opec members.

Oil surged above $63 (Dh231) a barrel to its highest level in two years last week after Saudi Arabia’s crackdown on princes and businessmen raised concerns over stability and policymaking in the world’s largest oil producer.

Brent rose to $64.65, its highest since June 2015 and WTI rose to $57.92 a barrel, its highest since July 2015 earlier last week.

Oil was moving upwards even before Saudi Crown Prince Mohammad Bin Salman launched his purge which included the detention of billionaire investor Al Waleed Bin Talal, the head of Kingdom Holding with stakes in Twitter, Citigroup, Apple, among others.

“Although political developments in Saudi are fascinating they are unlikely to have much impact on oil price because a significant change in Saudi oil policy is unlikely. More significant would be any developments in Kurdistan to re-establish the lost production or exports or anything further said in the US about re-instating sanctions on Iran,” said Spencer Welch, Director of IHS Energy in London.

In a speech delivered last month, President Donald Trump had refused to certify that Tehran was complying with the terms of a landmark deal reached between six world powers in 2015 that is aimed at controlling Iran’s nuclear program.

Oil gained more than 20 per cent since the beginning of September on signs global supplies are tightening and Opec and its allies may extend output deal beyond March. Fighting between Iraqi government and Kurdish forces over the disputed oil rich region of Kirkuk also boosted prices.

Meeting

Opec (Organisation of the Petroleum Exporting Countries) along with other oil producers are cutting production by 1.8 million barrels per day in order to prop up prices. The agreement, which was to expire in June, was extended till March next year.

“Oil markets are waiting for the Opec meeting on November 30, the market expectation is that the supply cut deal will be extended through to end-2018,” Welch said.

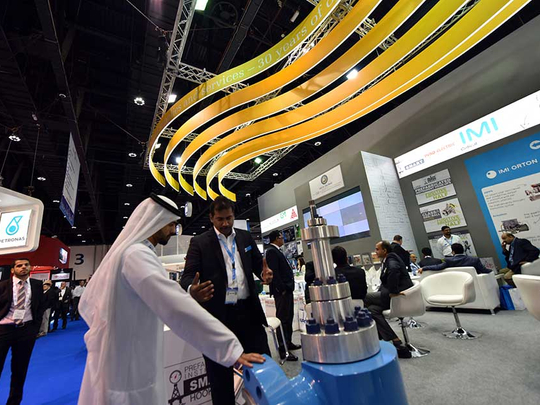

To be held under the theme “Forging Ties, Driving Growth”, Adiepec 2017 is expected to host more than 10,000 delegates, 2,200 exhibiting companies, 900 speakers, and in excess 100,000 visitors from 135 countries.

Saudi Aramco will be sending its biggest ever delegation to the event as Middle East national oil companies (NOCs) establish new commercial partnerships and diversify their operations to ensure sustained long-term growth.

With a production capacity of around 12 million barrels of oil per day and rights to at least 260 billion barrels of recoverable oil in the kingdom, Saudi Aramco controls around 15 per cent of the world’s oil reserves.

Adnoc’s offshore concession will also be in focus during the four-day event. The firm is in advanced discussions with more than a dozen potential partners in awarding an offshore oil concession, currently operated by the Abu Dhabi Marine Operating Company (Adma-Opco), that expires next March.